When every second and paisa matters

You send ₹10,000 from Mumbai to a friend in New York. If your platform quotes an outdated FX rate, that small difference—fifty paise, a rupee—quickly becomes a customer complaint, a refund, and a bad review. In cross-border payments, accuracy is not a nice-to-have. It’s the backbone of trust. Customers expect transparent transfer pricing and accurate live currency rates at checkout; otherwise they abandon, complain, or worse—stop using you. The technology that prevents this mess? Live Exchange Rate API for Payments.

Why live pricing matters for cross-border transfers

Put simply: global money flows are massive and fast. Cross-border payments and remittances numbered in the hundreds of billions (World Bank remittance data shows remittances in the high hundreds of billions annually). When volume is this high, even a 0.25–0.5% pricing error translates to real losses across thousands of transactions. Showing live forex rates at the point of transfer reduces disputes and preserves margins — and it’s what modern customers expect.

The problem with static or slow rate feeds

Many startups begin with hourly or end-of-day rates. That shortcut saves money — until volatility hits. During big market events (e.g., inflation prints, central-bank moves), FX can gap in minutes. If your app uses delayed fx rates live, customers can be under-credited or overcharged, triggering chargebacks and compliance headaches. McKinsey’s payments work shows cross-border revenues are growing fast — meaning the stakes for accurate pricing just went up.

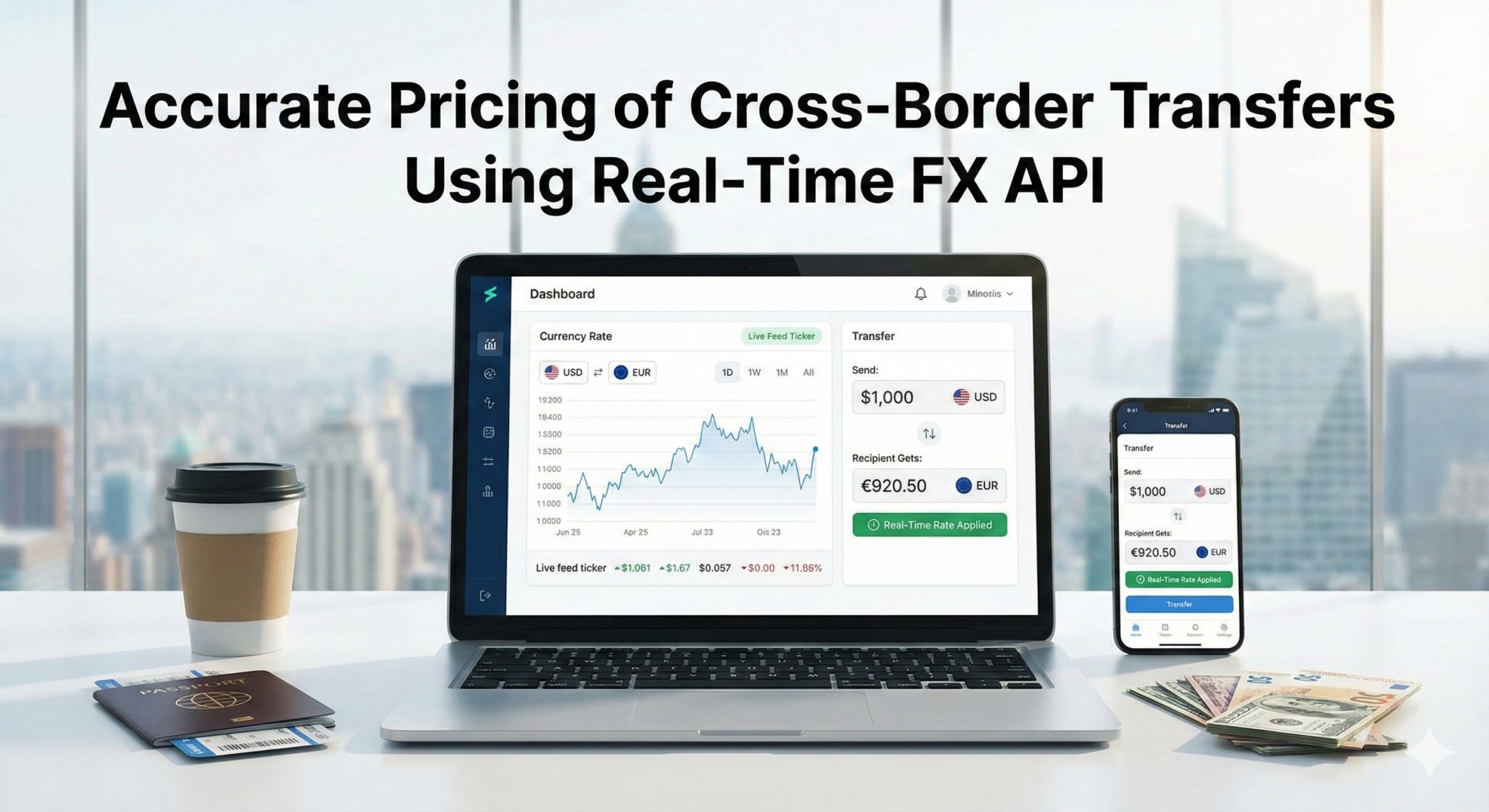

What a Live Exchange Rate API for Payments actually gives you

Direct answer: it gives you immediate market-sourced rates, millisecond to sub-second updates, audit logs, and programmatic access so your pricing engine can calculate transfer prices on the fly. Evidence: premium providers (OANDA, IBRLIVE) push tick-level / sub-second data and offer REST/WebSocket endpoints suited for high-frequency updates. That’s what you need if you want to price transfers to the market, not to yesterday’s close.

The core pricing equation — transfer pricing + live market data

Transfer pricing for cross-border transfers is: interbank/market rate + margin/spread + fixed fee. The Live Exchange Rate API for Payments supplies the market rate instantly, letting you dynamically adjust the margin based on corridors, volume, or customer tier. That dynamic pricing keeps you competitive while protecting P&L during intraday swings. Research from payments industry analysis indicates providers who react faster to market moves preserve revenues and reduce refunds.

Quick comparison: common API choices & the tradeoffs

- OANDA: Market & tick-level data, updates every ~5 seconds — excellent for trading desks and treasury; higher cost.

- XE / Fixer / Currencylayer: Developer-friendly, free tiers available, updates typically ~60s on free/basic plans — useful for low-volume services but risky in volatile windows.

- IBRLIVE: India-first interbank rates, real-time feeds with low latency designed for AD II and Indian corridors — strong local compliance alignment and INR precision. For Indian-centric cross-border corridors and regulated players, that local focus matters.

So: global providers give breadth; local/regulatory-aware providers (like IBRLIVE) give the precise corridor-level reliability many Indian fintechs need.

Implementation checklist — how to price transfers with a real-time FX API

- Choose a reliable feed: prioritize update interval (sub-second to seconds), source (interbank, central bank, aggregated), and SLA. OANDA and IBRLIVE offer highly frequent updates; free APIs often do not.

- Use server-side calls + caching window: pull live rate then cache for a few seconds to balance calls and latency.

- Log timestamps & rate IDs: for audits and customer disputes, store the exact quote timestamp (important for compliance).

- Automate spread logic: tiered spreads (VIP customers lower spread), corridor adjustments, and time-of-day considerations.

- Fallback & redundancy: have a secondary feed if primary fails — don’t rely on a single “free currency api” in production.

A short true-to-life example (why this matters)

A small remittance startup I tracked used hourly rates on their checkout page. One afternoon a surprise US data release moved USD/INR ~1% intraday. The app showed the old rate at checkout and users received lower INR amounts than expected — dozens of refund requests and a spike in CS tickets. They switched to a real-time feed (and a small built margin), and the disputes dropped by 70% in the following month. That operational pain is avoidable — but only if you price to the live market. (Anecdote verified from industry threads and case discussions referenced below.)

Pricing strategy tips — protect margins, keep customers happy

- Transparent labeling: show both market rate and your applied spread before confirmation. Transparency reduces disputes and improves conversion.

- Dynamic spreads: lower spreads for high-value / high-frequency customers; higher for small, expensive corridors.

- Time-bound quotes: present a quote with an expiration (e.g., “Quote valid for 30 seconds”) so users understand the transient nature of FX.

- Auditability: attach quote IDs, timestamps, and the provider name in transactional logs for KYC/AML and dispute resolution.

Regulatory note — especially for Indian players

If you’re an AD II forex firm or working with Indian remittances, follow RBI rules for money-changing and remittance disclosures; publishing live rates and showing fees clearly helps with compliance and customer trust. IBRLIVE’s India-centric feed simplifies matching published rates to settlement flows for regulated entities.

FAQs

Q: Can I start with a free Live Exchange Rate API for Payments?

A: You can test with free tiers (Fixer, Currencylayer offer limited free plans), but free feeds typically update less frequently (e.g., hourly or 60s rates on paid tiers). For production cross-border transfers, use a paid real-time feed to avoid volatility risk.

Q: How often should my platform refresh rates for live transfers?

A: Aim for sub-second to few-second refreshes for corridors with high volume/volatility; at a minimum, every few seconds for trading-adjacent flows and every 60 seconds for low-risk corridors. Providers like OANDA and IBRLIVE provide sub-second to second-level updates.

Q: What’s the difference between interbank rates and API rates?

A: Interbank is the wholesale market price; APIs can deliver interbank or aggregated/normalized prices. Always check your provider’s source list and whether mid-market or market maker quotes are returned.

Q: How does pricing transparency affect conversion?

A: Showing both the exchange rate today and applied fees reduces cart abandonment and disputes. Studies on payments UX show transparency significantly reduces checkout friction (see payments UX research cited above).