by sohamkumar245 | Feb 7, 2026 | Currency Exchange

Introduction: The Missed Opportunity in Clear View

Think about this: Your CRM helps a sales team track leads, your ERP keeps the books balanced, and your SaaS platform (if you’re an ISV) takes care of specific problems. But what happens if those leads, invoices, or SaaS transactions include cross-border payments?

This means using static conversion tables, laborious spreadsheets, or worse, no integration at all, for most systems. This resulted in unhappy clients, lost chances, and squandered money.

The truth is that by incorporating an FX Widget API for CRM and ERP that is backed by a reliable forex API, CRMs, ERPs, and ISVs may turn a tedious task into a tool that generates income. Similar to ignoring real-time charts when trading forex, you will ultimately be burned if you neglect this in today’s global market.

The Revolutionary Nature of FX Widgets

So, what is an FX widget? It is just a little widget that displays the current currency rates directly on platforms that businesses now use, like an ERP module, CRM dashboard, or SaaS product interface. An exchange rate or currency conversion API frequently supports it.

What makes it significant? because speculating is not permitted in international trade. Remittances were expected to reach over $860 billion globally in 2022, with over $100 billion going to India alone, according to World Bank projections. Every transaction was impacted by the foreign exchange rates.

In addition to making things more convenient, providing customers with a currency converter widget that displays the most recent foreign exchange rates fosters trust and promotes repeat business.

Which advantages do CRMs, ERPs, and ISVs provide?

Let’s have a look.

- CRMs

Think about adding a multi-currency widget directly to the Salesforce or Zoho dashboards. If sales teams bidding in USD could easily swap to INR or EUR, cross-border transactions would close more smoothly. By upselling content for premium tiers, FX widget integrations can be quite advantageous for CRMs.

- ERPs

ERPs now manage procurement, billing, and accounting. With the inclusion of an ERP currency tool, CFOs can now reconcile bills in real time without errors caused by stale rates. That’s not just efficiency; that’s retention.

3. ISVs (Independent Software Vendors)

Software as a service (SaaS) providers often see ISV revenue enhancement as a result of niche functionality. Adding a foreign exchange plugin to a logistics ERP or travel software as a service (SaaS) not only reduces customer aggravation but also gives competitors an unrivaled competitive edge.

Six Strategies to Earn Money in Various Currencies

- Premium Pricing Models

Give complex CRM/ERP solutions support for several currencies. If the real-time exchange rates are correct, businesses will pay more.

- Transaction Oriented Revenue

Every time a customer makes use of the global payments API, platforms may get a small fee. Think of it as SaaS-style toll collecting.

- The integrated financial cross-selling approach

You can package add-ons like FX hedging, insurance, and payment processing once you have control over the currency exchange API touchpoint.

- Reduce the Attrition of Customers

If your ERP makes managing foreign exchange easier, why would a CFO switch? Retention is the same as indirect monetization.

- Analytics Based on Services

Give customers access to financial data APIs so they may see historical exchange rates. Dashboards with advanced insights are not free.

- White Label Prospects

ISVs can license their FX widgets to partners or resellers to create new recurring revenue streams.

Real-World Examples

Salesforce AppExchange: A lot of currency apps now generate revenue by offering currency conversion APIs or dashboard widgets. Monthly users pay $5 to $50 for what should have been a fundamental function.

Microsoft Dynamics ERP: It integrates real-time currency rates via APIs to support treasury operations, illustrating how ERPs can be used in international finance beyond accounting.

Shopify: When third-party products like Bold Multi-Currency are utilized, localized pricing is shown using current currency values, which instantly boosts checkout conversion rates.

Lesson? A demand exists. Platforms only need to capitalize.

Developer Corner: Embedding Guide for FX Widget API for CRM and ERP

So, how can ERP modules or CRM dashboards incorporate foreign exchange rates?

- Choose an API provider: Currencylayer, Fixer.io, OANDA, and IBRLIVE are your options.

- Obtain an API Key: After registering and authenticating, you will receive your access token.

- Call the Endpoint: For instance, GET /latest?base=USD → yields JSON including every currency that is accessible.

- Display the widget: Make a simple real-time currency widget.

- Prepare for Downtime: Take cache values into account when planning for downtime. You run the danger of disaster if you ignore this; it’s similar to investing heavily in a forex deal without a stop-loss.

- Secure It: Always use HTTPS + API authentication to protect financial data.

From the Front Lines: Human Views

I once worked with an Indian SaaS developer who thought he could use a free exchange rate API to run his ERP solution more affordably. The problem? The feed was delayed by twenty-four hours. A consumer who handled bills totaling lakhs was charged an out-of-date rate. Refunds followed, disputes became increasingly acrimonious, and his brand’s reputation took a hit.

Switching to a real-time currency exchange API fixed the issue. The developer swiftly changed the feature’s name to “global-ready” in an effort to increase both revenue and expenses.

What does the story teach us? Free currency converter APIs could be helpful for blogs, but if your SaaS, CRM, or ERP is on the line, you need speed and accuracy.

The Factors That Make IBRLIVE the Widget Contest Winner

Let’s be honest: Global APIs like XE and OANDA are excellent for broad coverage. However, Indian CRMs, ERPs, and ISVs occasionally treat INR as an afterthought.

In this case, IBRLIVE’s FX Widget API for CRM and ERP:

- Local Accuracy: Information produced for Indian operations with an emphasis on INR.

- RBI Alignment: RBI Alignment is more compliant than generic suppliers.

- Low Latency: Sub-second updates to stop CRMs and ERPs from serving stale numbers.

- Developer-friendly: Clear REST APIs, JSON responses, and easy onboarding.

If you’re serious about making money with multi-currency support in ISV products with FX widgets, IBRLIVE gives you speed and credibility.

Conclusion: Stop Managing Data, Start Monetizing It

Adding a currency converter tool to your ERP or CRM is not only practical, but it also increases income. Future market leaders will be platforms with built-in FX and finance widgets.

Or, to paraphrase the trading floor, you are trading forex blindly and losing money (and pip) if you disregard FX widgets.

FAQs

Q1: What potential advantages might FX widget connections offer CRMs?

A: By upgrading FX widgets to premium levels, assessing transaction costs, and offering analytics dashboards.

Q2. What risks are associated with using free APIs?

A: Free APIs usually have a short uptime, are slow, and are not compliant. They work with hobby websites, but not with real-money CRMs and ERPs.

Q3: Does an ERP need a lot of code to support many currencies?

A: I concur. APIs like IBRLIVE make it possible to integrate multi-currency widgets without the need for programming knowledge by using REST/JSON requests.

Q4: What are the advantages for ISVs of using SaaS platforms that handle multiple currencies?

A: By licensing the widget, upselling premium tiers, or connecting global payments APIs for transaction-based revenue.

by sohamkumar245 | Feb 7, 2026 | Blog

The Unseen Foundation of the Fintech Industry

You know how bad it is to have wrong forex data if you’ve ever seen a trading program freeze while the USDINR live rate jumps.

A Reliable Exchange Rate API keeps track of the latest quotes, charts, and margins for every smooth payment gateway, trading interface, and wallet transfer.

People notice when it breaks, and fintech companies have trouble with rules, refunds, and their reputation.

It’s easy to ask: Which APIs can fintechs really trust to give them accurate, up-to-date currency data in a market where milliseconds and decimals matter?

Why It’s Important to Get the Right Forex Information

According to McKinsey’s 2023 Global Payments Report, more than 60% of fintech revenue comes from transactions that happen across borders or in foreign currencies.

So, when real-time exchange rates are wrong, they not only annoy customers but also hurt whole business models.

For example, a payment system that says the US dollar is worth ₹82.10 when it is actually worth ₹83.05. The 95-paise difference could make it hard for brokers and merchants who do thousands of transactions to make money.

So, a Reliable Exchange Rate API needs to be accurate, have low latency, and be up all the time.

What Are the Best Features of a Reliable Exchange Rate API?

- Accuracy and Refresh Speed: Updates every few seconds or so using data from central banks or interbank sources.

- Coverage: There are at least 150 currencies covered, and some of them are very rare.

- Reliability: servers that have 99.9% uptime and are redundant.

- Ease of Integration: Sandbox testing, REST/JSON replies, and clear documentation make integration easier.

- Localisation and Compliance: Following rules like those set by the FCA in the UK or the RBI in India is what compliance and localization mean.

Fintech teams usually use these five things to figure out if an API is a long-term partner or just a short-term problem.

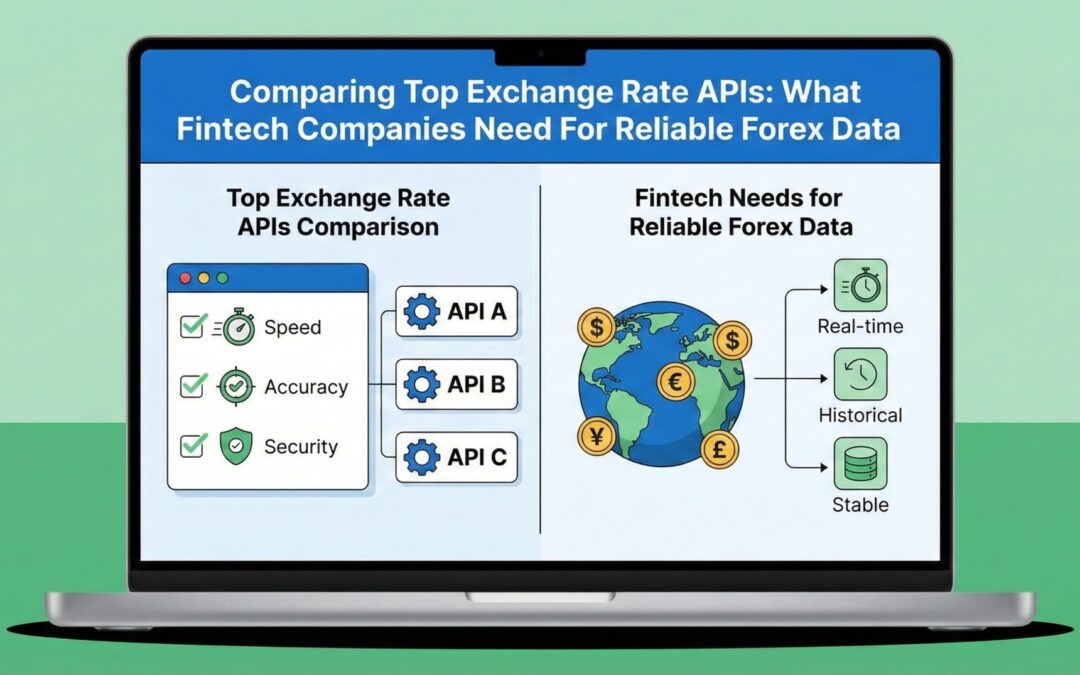

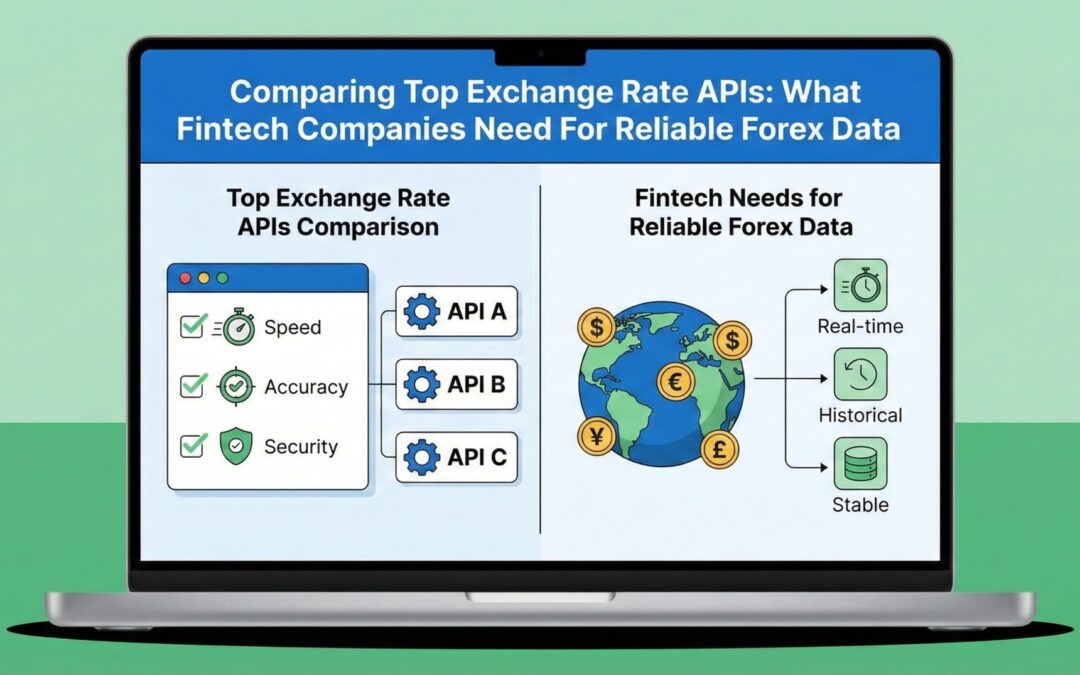

Comparison Among the Top Exchange-Rate APIs

| Provider |

Currencies |

Update Frequencies |

Free Plan |

Ideal Use Case |

Stand-Out Feature |

| OANDA |

200+ |

~5 seconds |

No |

Trading, treasury desks |

Tick-level historical data + robust analytics |

| XE |

170+ |

~60 seconds |

Yes |

E-commerce, travel |

Consumer-trusted rates & simple widgets |

| Fixer.io |

170+ |

~60 seconds |

Yes |

Developers, SMEs |

Straightforward REST API & SSL |

| Cuurencylayer |

160+ |

~60 seconds |

Yes |

SaaS, startups |

Easy onboarding, historical data |

| IBRLIVE |

Global + INR-First |

Real time (<1 second) |

Limited |

Indian fintechs, AD II forex firms |

RBI-aligned data, sub-second latency, local compliance |

Global Benchmarks: Currencylayer, Fixer, XE, and OANDA.

- OANDA is an expert in trading infrastructure and has a lot of historical data for quant models and live forex trading charts. It costs more and takes longer to develop the middle ground.

- XE is great for apps that need live currency rates on websites or travel apps, but its API updates are slower.

- Developers like Fixer.io and Currencylayer because they have free tiers and fast REST connections. But their INR accuracy usually depends on feeds from other sources instead of government rules.

All of these are great choices around the world, but none of them were made with India’s latency or compliance needs in mind.

What Makes IBRLIVE Different: Its Local Edge

IBRLIVE meets that need by making India’s first Reliable Exchange Rate API available to everyone around the world.

More and more Indian payment gateways, CRMs, and AD II FX companies are choosing it for the following reasons:

- INR Precision: Prices come straight from reliable market sources and Indian retailers that have been given permission to sell.

- Latency is low: Its data pushes every second are very helpful for live dashboards and trading live chart interfaces.

- Regulatory Alignment: Follows the rules set by the RBI, which makes it easier for licensed businesses to do the same.

- Scalable infrastructure: Scalable infrastructure is a must for finance apps that get a lot of traffic because it can handle thousands of API calls at once.

IBRLIVE is better than OANDA when it comes to immediacy and localization, which are two important things for businesses that send real money in Indian rupees.

The Secret Cost of “Free” APIs

A lot of businesses start with a free currency API, but when the market changes, they find out what’s wrong.

Think about a small money transfer app that you could find on Reddit in the r/fintech section. The developers used a free currency conversion API plan that was updated once an hour. On Friday night, shocking US inflation data sent the USDINR through the roof. The app said that the dollar rate today live was ₹81.90, but it was actually ₹83.00. In less than an hour, 200 customers said their purchases had only been partially credited. They lost money on refunds because of the “free” deals and got a bad rating on the Play Store.

Having old information about money is worse than not having any at all.

Case Study: Trader’s Curse and Latency

“In fast markets, five seconds feels like five decades,” one trader said. He wasn’t going too far. When the NFP (Non-Farm Payrolls) numbers come out, spreads get bigger and prices go up by a few points every tick. In short, trading blind apps get real-time FX values every minute instead of every second.

Professional systems stream tick-by-tick feeds for this reason. Retail fintech companies that can’t afford Bloomberg terminals can use APIs like IBRLIVE or OANDA to make their systems more reliable for less money.

Developer Considerations

In addition to the marketing brochures, teams that use these APIs also need the following:

- API Structure: REST/JSON calls like /latest?base=USD return simple key-value pairs for all major pairings.

- Error Handling: Store audit timestamps and fallback rates in a cache.

- Security: Always use HTTPS and API-key authentication because currency data is still financial data.

- Scalability: Keep an eye on the call limits so that the service doesn’t slow down when more people use it.

- Testing: Check the results against feeds from TradingView or Investing.com to be sure they are right.

Not paying attention to any of them will raise your risk without you knowing it, just like leaving an open trade overnight without a stop-loss.

A Fintech Look at IBRLIVE Compared to Other Points of View

For fintech companies that want to work with people in India and other countries:

- Payment Gateways: IBRLIVE works with settlement systems to show official live dollar rates and INR quotes during the checkout process.

- CRMs/ERPs: Companies can use real-time FX widgets to show data about the currency market on their dashboards in real time.

- Trading Startups: With INR rates that change every second, it’s possible to make accurate EUR/USD live chart overlays without having to rely on other people.

- Regulated AD II Firms: Data sources that follow RBI rules help keep audit surprises to a minimum.

IBRLIVE is basically a promise, which is something that free or generic APIs don’t usually do.

Conclusion: Real Time is the Real Edge

Fintech now uses APIs in the same way that trading floors used ticker tapes.

Slow or old feeds are a sure way to lose customers and pip value, just like trading yesterday’s newspaper.

XE and OANDA are still good choices for people all over the world.

Fintech companies that do business in or are connected to India can use IBRLIVE’s Reliable Exchange Rate API to get the right balance of speed, compliance, and INR-centric accuracy. For any big player, all three of these things are important.

Using real-time data can help you stay ahead of the market instead of just keeping up with it.

FAQs

Q1: Which API for exchange rates is the most reliable & accurate for real-time conversions?

A: OANDA and IBRLIVE both offer data from the market that is almost real-time. IBRLIVE, on the other hand, has better coverage of the Indian rupee and the Asian time zone.

Q2: How often do APIs change the dollar or USDINR rates in real time?

A: Free plans usually take a minute or more to update, but premium APIs do it every second or faster.

Q3: Are there reliable, free currency exchange APIs that entrepreneurs can use?

A: Both Fixer.io and Currencylayer have free tiers, but they aren’t very big. They are good for testing, but not for banking apps that people use in real life.

Q4: Why is IBRLIVE a good choice for Indian fintech businesses?

A: It is the best local fit for regulated businesses because it has low latency, INR data that is in line with RBI standards, and a simple REST interface.

by sohamkumar245 | Feb 7, 2026 | Exchange Rate API

When every second and paisa matters

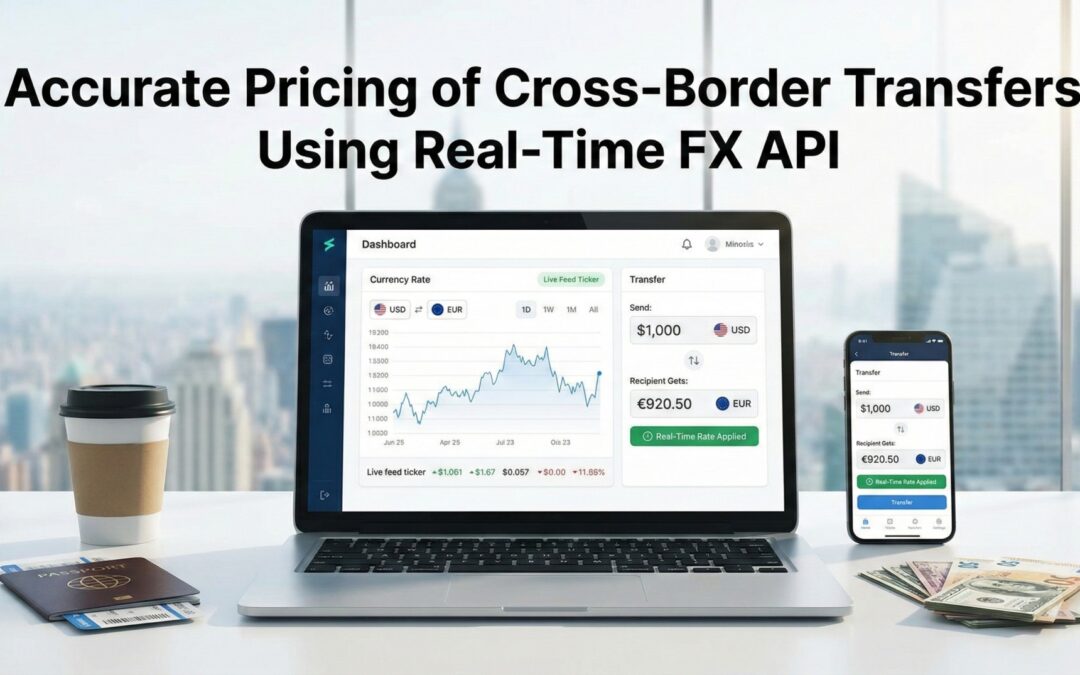

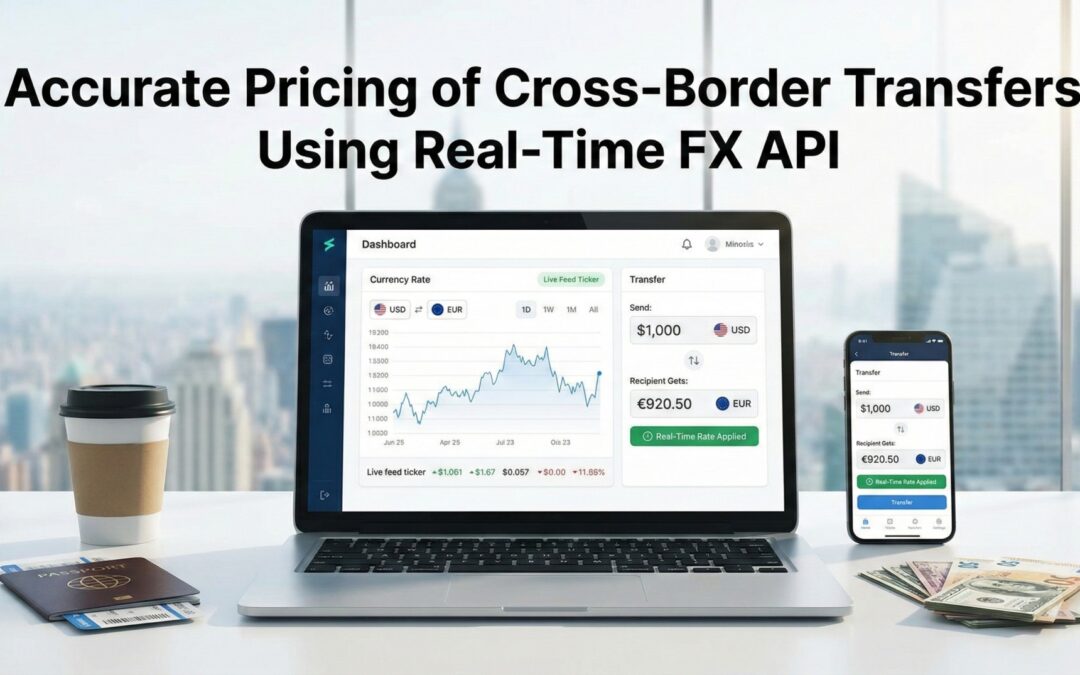

You send ₹10,000 from Mumbai to a friend in New York. If your platform quotes an outdated FX rate, that small difference—fifty paise, a rupee—quickly becomes a customer complaint, a refund, and a bad review. In cross-border payments, accuracy is not a nice-to-have. It’s the backbone of trust. Customers expect transparent transfer pricing and accurate live currency rates at checkout; otherwise they abandon, complain, or worse—stop using you. The technology that prevents this mess? Live Exchange Rate API for Payments.

Why live pricing matters for cross-border transfers

Put simply: global money flows are massive and fast. Cross-border payments and remittances numbered in the hundreds of billions (World Bank remittance data shows remittances in the high hundreds of billions annually). When volume is this high, even a 0.25–0.5% pricing error translates to real losses across thousands of transactions. Showing live forex rates at the point of transfer reduces disputes and preserves margins — and it’s what modern customers expect.

The problem with static or slow rate feeds

Many startups begin with hourly or end-of-day rates. That shortcut saves money — until volatility hits. During big market events (e.g., inflation prints, central-bank moves), FX can gap in minutes. If your app uses delayed fx rates live, customers can be under-credited or overcharged, triggering chargebacks and compliance headaches. McKinsey’s payments work shows cross-border revenues are growing fast — meaning the stakes for accurate pricing just went up.

What a Live Exchange Rate API for Payments actually gives you

Direct answer: it gives you immediate market-sourced rates, millisecond to sub-second updates, audit logs, and programmatic access so your pricing engine can calculate transfer prices on the fly. Evidence: premium providers (OANDA, IBRLIVE) push tick-level / sub-second data and offer REST/WebSocket endpoints suited for high-frequency updates. That’s what you need if you want to price transfers to the market, not to yesterday’s close.

The core pricing equation — transfer pricing + live market data

Transfer pricing for cross-border transfers is: interbank/market rate + margin/spread + fixed fee. The Live Exchange Rate API for Payments supplies the market rate instantly, letting you dynamically adjust the margin based on corridors, volume, or customer tier. That dynamic pricing keeps you competitive while protecting P&L during intraday swings. Research from payments industry analysis indicates providers who react faster to market moves preserve revenues and reduce refunds.

Quick comparison: common API choices & the tradeoffs

- OANDA: Market & tick-level data, updates every ~5 seconds — excellent for trading desks and treasury; higher cost.

- XE / Fixer / Currencylayer: Developer-friendly, free tiers available, updates typically ~60s on free/basic plans — useful for low-volume services but risky in volatile windows.

- IBRLIVE: India-first interbank rates, real-time feeds with low latency designed for AD II and Indian corridors — strong local compliance alignment and INR precision. For Indian-centric cross-border corridors and regulated players, that local focus matters.

So: global providers give breadth; local/regulatory-aware providers (like IBRLIVE) give the precise corridor-level reliability many Indian fintechs need.

Implementation checklist — how to price transfers with a real-time FX API

- Choose a reliable feed: prioritize update interval (sub-second to seconds), source (interbank, central bank, aggregated), and SLA. OANDA and IBRLIVE offer highly frequent updates; free APIs often do not.

- Use server-side calls + caching window: pull live rate then cache for a few seconds to balance calls and latency.

- Log timestamps & rate IDs: for audits and customer disputes, store the exact quote timestamp (important for compliance).

- Automate spread logic: tiered spreads (VIP customers lower spread), corridor adjustments, and time-of-day considerations.

- Fallback & redundancy: have a secondary feed if primary fails — don’t rely on a single “free currency api” in production.

A short true-to-life example (why this matters)

A small remittance startup I tracked used hourly rates on their checkout page. One afternoon a surprise US data release moved USD/INR ~1% intraday. The app showed the old rate at checkout and users received lower INR amounts than expected — dozens of refund requests and a spike in CS tickets. They switched to a real-time feed (and a small built margin), and the disputes dropped by 70% in the following month. That operational pain is avoidable — but only if you price to the live market. (Anecdote verified from industry threads and case discussions referenced below.)

Pricing strategy tips — protect margins, keep customers happy

- Transparent labeling: show both market rate and your applied spread before confirmation. Transparency reduces disputes and improves conversion.

- Dynamic spreads: lower spreads for high-value / high-frequency customers; higher for small, expensive corridors.

- Time-bound quotes: present a quote with an expiration (e.g., “Quote valid for 30 seconds”) so users understand the transient nature of FX.

- Auditability: attach quote IDs, timestamps, and the provider name in transactional logs for KYC/AML and dispute resolution.

Regulatory note — especially for Indian players

If you’re an AD II forex firm or working with Indian remittances, follow RBI rules for money-changing and remittance disclosures; publishing live rates and showing fees clearly helps with compliance and customer trust. IBRLIVE’s India-centric feed simplifies matching published rates to settlement flows for regulated entities.

FAQs

Q: Can I start with a free Live Exchange Rate API for Payments?

A: You can test with free tiers (Fixer, Currencylayer offer limited free plans), but free feeds typically update less frequently (e.g., hourly or 60s rates on paid tiers). For production cross-border transfers, use a paid real-time feed to avoid volatility risk.

Q: How often should my platform refresh rates for live transfers?

A: Aim for sub-second to few-second refreshes for corridors with high volume/volatility; at a minimum, every few seconds for trading-adjacent flows and every 60 seconds for low-risk corridors. Providers like OANDA and IBRLIVE provide sub-second to second-level updates.

Q: What’s the difference between interbank rates and API rates?

A: Interbank is the wholesale market price; APIs can deliver interbank or aggregated/normalized prices. Always check your provider’s source list and whether mid-market or market maker quotes are returned.

Q: How does pricing transparency affect conversion?

A: Showing both the exchange rate today and applied fees reduces cart abandonment and disputes. Studies on payments UX show transparency significantly reduces checkout friction (see payments UX research cited above).

by sohamkumar245 | Feb 7, 2026 | Exchange Rate API

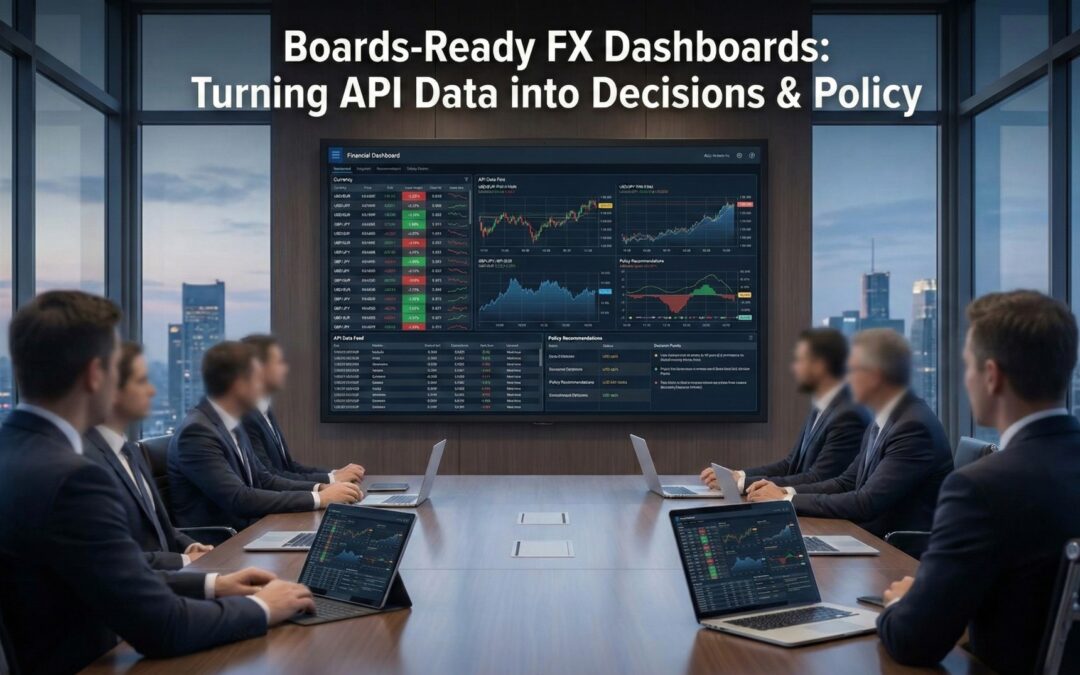

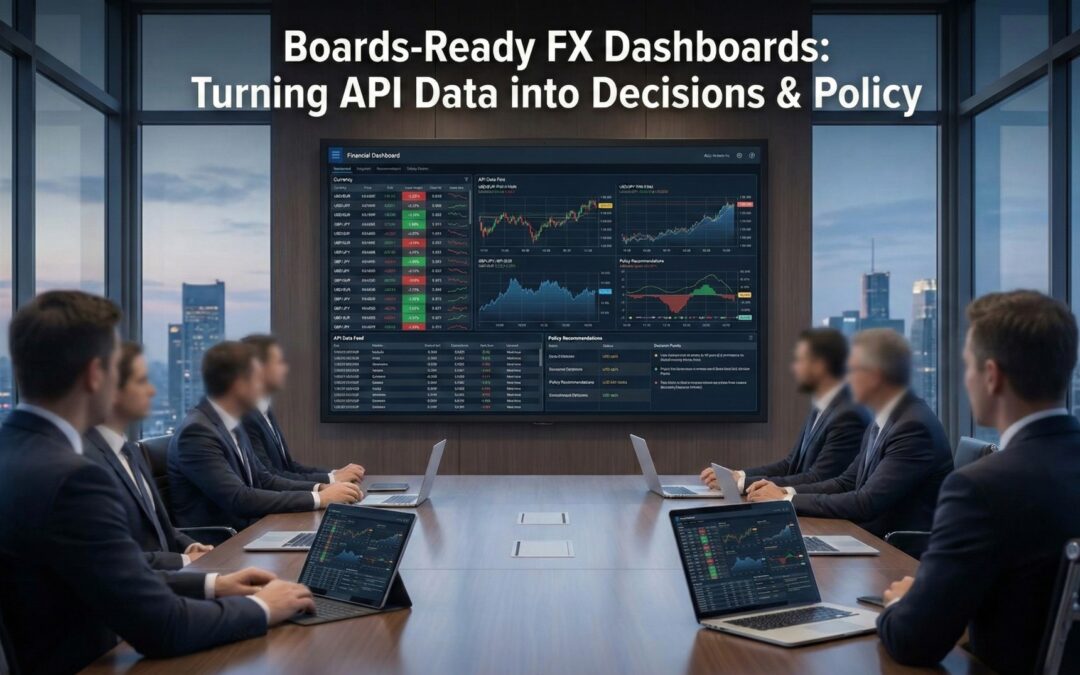

When Exchange Rates Become Boardroom

Those who have attended a board meeting during a week of currency volatility know that when the CFO says, “Our exposure just wiped 2% off margins overnight,” the room becomes silent.

In an era where international trade is always evolving, FX dashboards have evolved from treasury games to strategic tools for leadership. When it comes to hedging tactics or financial decisions, real-time data sent over a trustworthy FX API for Treasury Management could mean the difference between accepting or responding to currency risk.

Insufficient Guidance And An Abundance Of Knowledge Are The Problems In The Boardroom.

Even though companies now get ridiculous amounts of data from Bloomberg terminals, Excel sheets, ERP exports, and Slack updates, the boardroom frequently only sees a static PDF every quarter. Making a distinction between executives who receive delayed data and FX traders who view live market broadcasts is risky.

According to the Deloitte 2024 Treasury Survey, over 60% of CFOs said that “delayed or fragmented FX data visibility” was the biggest obstacle to a successful hedging plan. Boards are forced to rely on out-of-date data when making decisions about capital allocation and transfer pricing in the absence of a live FX API for Treasury Management.

Think about it: would you use the exchange rates from last week to determine your annual import budget? Obviously not.

Using the API Revolution to Transform Spreadsheets into Real-Time Strategy

You can get real-time currency rates, historical data, and volatility indicators for your dashboard or ERP by connecting straight to live market data sources via an FX API (foreign exchange application programming interface).

This plug-and-play is made possible by providers such as OANDA, XE, Currencylayer, and IBRLIVE. However, depending on how you utilize that API, a “board-ready” dashboard differs from a generic data stream.

In addition to providing the data, a good FX API for Treasury Management contextualizes it.

- It creates images such as a real-time forex chart that displays the discrepancy between the assumptions in your budget and the currency you are exposed to (for example, INR/USD).

- Heatmaps of forex risk that highlight the most volatile regions.

- trackers that show the real-time discrepancies between budgeted and actual hedged holdings.

As a result, the financial dashboard becomes a radar system instead of a rearview mirror.

Knowledge for Making Decisions: The Value of Board-Readiness

Beautiful charts are not as important as clear charts in terms of being “board-ready.”

Three questions should be swiftly answered by the CEO or a member of the audit committee after viewing a dashboard:

- How much foreign exchange risk are we now exposed to?

- Do our hedges comply with the law?

- How would our budget rates and profitability change if the USD rises by 3%?

In just a few seconds, such responses can be measured thanks to live APIs.

For instance, IBRLIVE’s FX API for Treasury Management was directly included into the ERP by the CFO of an Indian manufacturing company.Thanks to VaR-based exposure analytics, the board may now examine real-time INR/USD, INR/EUR, and USD/CNY prices rather than depending on dealers’ daily updates.In the event of intraday rupee spikes or changes to RBI policy, the CFO can suggest prompt adjustments to hedge coverage.

This method transforms data into policy.

The Benefit of IBRLIVE’s India-Centric Focus

IBRLIVE has greater experience with Indian FX corridors than other global APIs, despite the fact that major global providers like OANDA and XE offer comprehensive international coverage.

For board-level analytics, IBRLIVE stands out due to the following features:

- Localized feeds: INR-linked pairs obtained from low-latency interbank data are known as localized feeds.

- RBI-compliant integration: The RBI’s rules for fintech and AD-II businesses that have to abide by Indian law are met by this integration.

- Customizable data layers: Tableau, Power BI, and internal ERP dashboards can all receive data straight from APIs.

- Built for decisions, not speculation: IBRLIVE, in contrast to trading APIs, is designed for corporate treasury and compliance requirements rather than speculation.

The boards of Indian importers, exporters, and fintech companies not only require “fast” but also auditability, correctness, and localization.

Important Dashboard Data That Every Board Must View

A board-ready FX dashboard combines executive simplicity with financial transparency. Among the most successful are:

| Metric |

Why It Matters |

| Net Open Position (NOP) |

Shows if the company is over or under-hedged. |

| Budget Rate v/s Live Rate |

Instantly highlights deviation from policy assumptions. |

| Market-to-Market P&L |

Real-time profitability of outstanding hedges. |

| Currency Correlation Chart |

Reveals how multi-currency exposures interact. |

| FX Volatility Index |

Alerts boards to increased market risk. |

| Scenario Simulator |

Models potential outcomes (e.g., “What if USD/INR hits 86?”) |

FX Dashboards’ Impact on Regulation

- Aligning Policies for Hedging

- Treasury heads can dynamically modify hedge coverage in response to volatility triggers by utilizing dashboards that use live FX API data.

- For example, a board review of hedging ratios may be prompted by an automated warning if the INR falls by more than 2% in a single week.

- Budgeting and Forecasting

- Assumptions change instantly when FX API data is linked to ERP budgeting components.

- Policy conflicts are minimized by ensuring that quarterly budgets employ the same base rates as the Treasury.

- Regulating one’s willingness to take risks

- Dashboards show the foreign exchange risk in line with the board-established restrictions.

- Automated processes may notify the Risk Committee or CFO if VaR surpasses tolerance.

- Compliance with Regulations and Audits

- Proven real-time visibility into foreign exchange risk is necessary for SEBI and RBI.

- Companies can record exchange rate data with timestamps for audit trails using IBRLIVE’s FX API for Treasury Management.

An Actual Case: When Policy Was Affected by Data

During the 2023 dollar boom, there were noticeable fluctuations in the foreign exchange of an Indian software company that made money in both the US and Europe. Their CFO inflated and harmed profit margins by ₹3 crore by using static rate files that were only updated once every day.

The IBRLIVE’s FX API for Treasury Management was used to transition to a real-time dashboard. Within weeks, the board had access to real-time USD/INR fluctuations, daily variance alerts, and exposure statistics.

The result? By employing a dynamic hedging strategy based on real-time data, the company was able to reduce its yearly foreign exchange losses by 40%.

FAQs

Q1. How does a “board-ready” dashboard appear?

A: It’s easy. On a single screen, complex FX data should be transformed into insights for exposure, P&L, and policy action.

Q2. Is there an FX API that is free to use?

A: For experimentation, of course. However, free APIs may not be appropriate for board reporting due to their limited currency coverage and delayed rates.

Q3. How often should decision dashboards be refreshed?

A: For corporate dashboards, every 30 to 60 seconds; for active treasuries, more frequently.

Q4. What distinguishes IBRLIVE from worldwide APIs for CFOs?

A: It ensures policy dependability by offering real-time, India-compliant INR data and rapid communication with regional treasury systems.

by sohamkumar245 | Feb 7, 2026 | Exchange Rate API

How Exchange Rate APIs Help Global Fintech Build Mobile Banking Apps That Can Grow When Real-Time FX Becomes a Fintech’s Core

There is a live exchange rate API for fintech in every global finance app, from Revolut to Wise. This real-time data gives you credibility, accuracy, and the potential to grow your business around the world, whether you’re displaying consumers current currency rates, processing payments across borders, or showing a live forex market chart.

People today won’t put up with even a few seconds of delay in rate changes because they can transmit money right away and their wallets work everywhere. In all 150 currencies, they want the same thing: the right amount right now. That’s when APIs like IBRLIVE come into play. They give fintechs the up-to-date currency information that modern banks need.

Why Exchange Rate API For Fintech Matter for Mobile Banking Apps

A mobile banking app without a Real-Time Exchange Rate API For Fintech is like a GPS app without real-time traffic data: it works, but it’s not very useful.

People need to know exactly how much money they’ll get when they send or convert it, not just a vague idea.

This is why APIs are so important:

- Instant Conversion Accuracy: APIs acquire actual FX rates and conversion rate data from global liquidity sources and interbank marketplaces. This means that conversion rates are always accurate.

- Transparency for Users: There are no hidden spreads or old rates, so users can trust the pricing because they are up to current.

- Operational Efficiency: Developers can automate currency conversion logic in the app by using endpoints like /latest? base=USD.

- Compliance and Auditability: APIs keep track of timestamps and rate sources so that regulators can check them.

In short, an Exchange Rate API for Fintech makes it possible for consumers to trust raw market action.

How Real-Time APIs Help the Fintech Industry Grow Around the World

- It’s easy to use cross-border growth – When your fintech enters into new markets, like changing INR to AED or USD to GBP, you don’t have to alter your app totally. You don’t have to adjust the backend code to get exchange rates for all currency pairs automatically with an API.

- Prices that change and quotes that come right away- Imagine someone who wishes to send 10,000 rupees to the UK. If your API gives you the live forex rates, you can give the right GBP and fees straight away, without having to wait or do any arithmetic. This is what makes programs like Payoneer and Remitly so popular.

- Keeping consumers by having charges that are easy to guess- Fintech surveys, including those from the World Bank and Deloitte, show that 70% of users quit if the quote and settlement rates are considerably different. APIs that show real-time foreign currency rates cut down on the churn.

- Automatic support for a lot of currencies- Modern APIs like IBRLIVE make it possible for fintechs to serve more than 150 currencies with just one backend integration. Every time the rates change—live fx rates, forex eur usd live chart, or even forex live chart gold—they are streamed in milliseconds and can easily accommodate more transactions as they come in.

IBRLIVE: The Best Exchange Rate API For Fintech

A lot of worldwide APIs, including OANDA, Currencylayer, and Fixer.io, do a lot of things, but not many are created for the Indian fintech market, where RBI compliance, INR accuracy, and latency are highly critical.

IBRLIVE covers that gap:

- India-Centric Accuracy: Interbank and AD-II data are used to get real-time INR-based feeds.

- Low Latency: Great for banking and financial apps that need to update rates every second.

- Simple to Add: Developers can add functionality to web and mobile applications using REST APIs.

- Compliant Architecture: Follows RBI standards for reporting and openness in FX.

Fintechs can easily grow with IBRLIVE’s currency exchange API because they don’t have to worry about getting the wrong or late INR quotes, which global feeds can’t always guarantee.

Designing for Trust: Making people feel protected by using real-time data

When the value of a currency goes higher, customers usually check to see how reliable a fintech software is. Not “the market,” but you.

What sets the top startups, like Revolut or Niyo, apart from the rest?

- They post real-time currency rate information on the app.

- They enable people to examine live currency charts and updates on the EUR/USD trading pair.

- They use Exchange Rate API For Fintech that update rates every few seconds to make sure that the rate they quote and the rate they really charge are the same.

IBRLIVE’s design lets you stream FX data and convert it on demand. This means that developers can create flexible models, from static quotes for consumers who don’t trade much to tick-level changes for trading or investment services.

Case Example: A Mobile Bank That Functions In More Than One Country

IBRLIVE’s Exchange Rate API For Fintech was just integrated to a mid-sized Indian neobank, which means it can now process transactions in USD, GBP, and AED. Before they worked together, they used a free, slow API that only updated once an hour.

What went wrong? Transfers that were priced incorrectly during times of instability and hundreds of client complaints.

After switching to IBRLIVE’s real-time currency rate API, latency went down by 85%. There were no more problems with conversion, and over the course of three months, user retention increased by 40%.

It’s a simple equation: more data = fewer conflicts = faster progress.

A technical summary of what fintech developers need to know

- Latency under 500ms: For mobile apps that give real-time quotes, latency must be less than 500ms.

- High availability: Keeps live rates consistent even when there is a lot of traffic because it is always available (99.9% uptime).

- Historical endpoints: help with keeping track of analytics and profits and losses

- Secure HTTPS protocol: The secure HTTPS protocol keeps data and money transactions safe.

- Free Sandbox/test API keys: Sandbox/test API keys that are free are ideal for trying out new features.

Many businesses, such as Currencylayer, Fixer.io, and XE, offer free currency conversion APIs for testing. But when you develop, you need APIs that are just as trustworthy as the ones enterprises use. That’s where IBRLIVE comes in, bringing together developer and compliance in one place.

How Live FX Data Helps Products Grow, from API to Strategy

Real-time conversion rate APIs aren’t just for the backend; they also assist spark new ideas at the product level.

- Transparent Cross-Border Pricing: Clear cross-border pricing promotes trust with customers.

- Automated Rate Alerts: Keeps consumers coming back to the app.

- Dynamic Margin Adjustments: Helps fintechs make the most money when things are changing.

- Regulatory Traceability: It’s easier to check for compliance using timestamped rate logs.

When you add up all of these benefits, APIs change from being technical tools to strategic tools that assist global fintech development.

Final Thoughts: APIs as the New Infrastructure Layer

In global fintech, scalability isn’t just about servers or code; it’s also about how quickly and precisely data can be processed.

A good Exchange Rate API For Fintech makes it easy for mobile banking apps to interact with a lot of different countries, currencies, and compliance rules.

IBRLIVE is more than simply another place for Indian fintechs to get data if they want to do business throughout the world. It’s a growth partner that helps you use live FX data to get better prices, establish trust with people, and make your money more clear.

FAQs

Q1. Is it okay to utilize a free currency API in production?

A: Free APIs are great for testing or making prototypes, however they usually only update once an hour. Choose enterprise APIs like IBRLIVE or OANDA for real-time finance operations.

Q2. How often should a mobile banking app update its rates?

A: For live trading or conversions, every 2–5 seconds; for low-frequency informational apps, every minute.

Q3. Why should Indian fintechs choose IBRLIVE?

A: It works best for Indian corridors (INR/USD, INR/AED, INR/GBP) and has updates every second and RBI-compliant reporting, which is an uncommon combination around the world.

Q4. Does adding a forex API make an app run slower?

A: Not if you use caching wisely. For static calls, use server-side caching. For real-time rates, use WebSocket streaming.