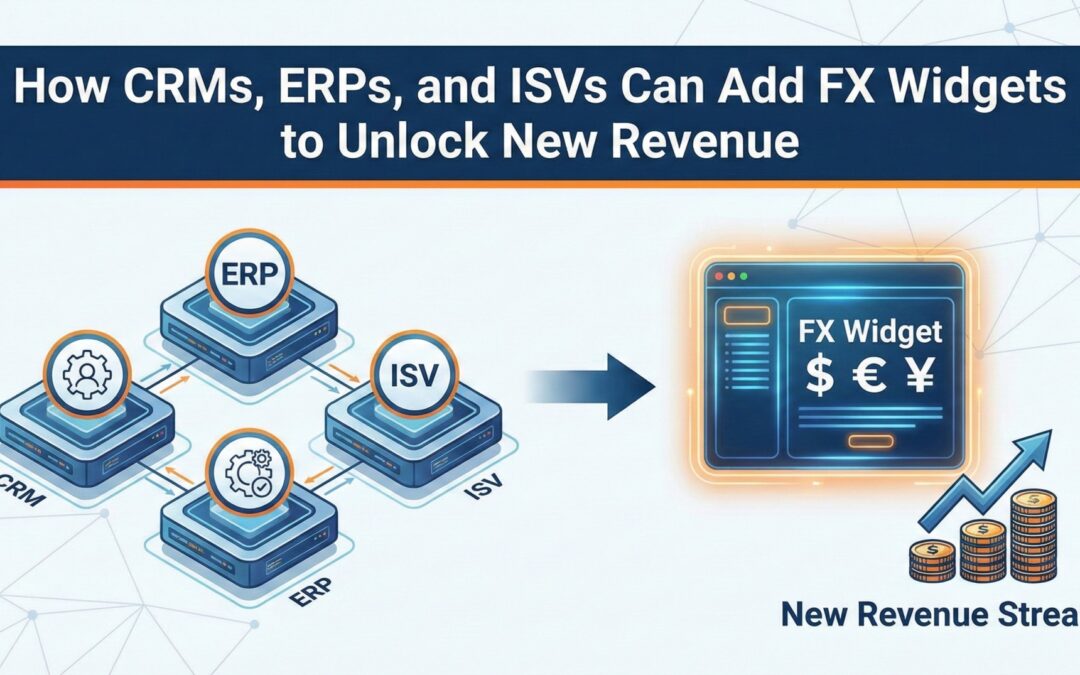

Introduction: The Missed Opportunity in Clear View Think about this: Your CRM helps a sales team track leads, your ERP keeps the books balanced, and your SaaS platform (if you're an ISV) takes care of specific problems. But what happens if those leads,...