by sohamkumar245 | Feb 7, 2026 | Exchange Rate API

When every second and paisa matters

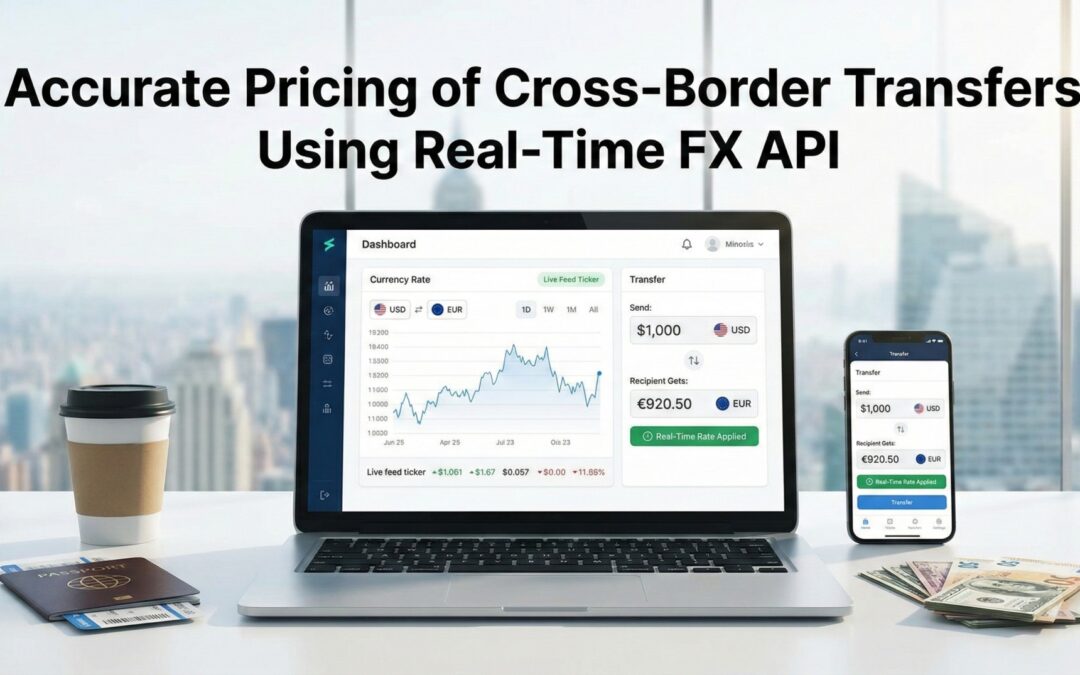

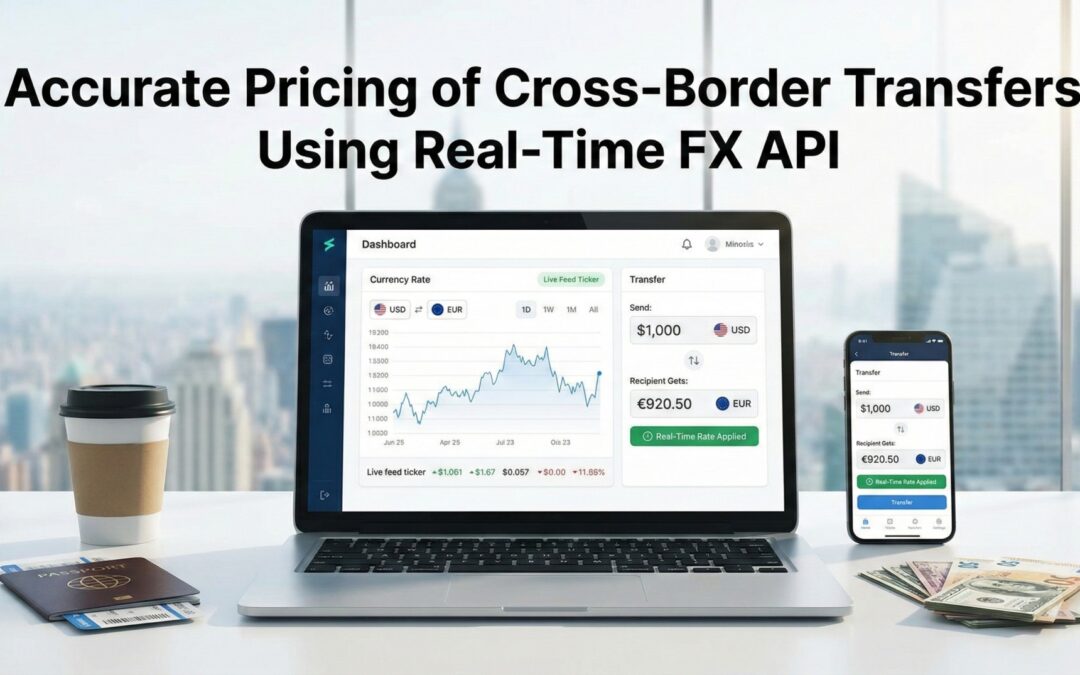

You send ₹10,000 from Mumbai to a friend in New York. If your platform quotes an outdated FX rate, that small difference—fifty paise, a rupee—quickly becomes a customer complaint, a refund, and a bad review. In cross-border payments, accuracy is not a nice-to-have. It’s the backbone of trust. Customers expect transparent transfer pricing and accurate live currency rates at checkout; otherwise they abandon, complain, or worse—stop using you. The technology that prevents this mess? Live Exchange Rate API for Payments.

Why live pricing matters for cross-border transfers

Put simply: global money flows are massive and fast. Cross-border payments and remittances numbered in the hundreds of billions (World Bank remittance data shows remittances in the high hundreds of billions annually). When volume is this high, even a 0.25–0.5% pricing error translates to real losses across thousands of transactions. Showing live forex rates at the point of transfer reduces disputes and preserves margins — and it’s what modern customers expect.

The problem with static or slow rate feeds

Many startups begin with hourly or end-of-day rates. That shortcut saves money — until volatility hits. During big market events (e.g., inflation prints, central-bank moves), FX can gap in minutes. If your app uses delayed fx rates live, customers can be under-credited or overcharged, triggering chargebacks and compliance headaches. McKinsey’s payments work shows cross-border revenues are growing fast — meaning the stakes for accurate pricing just went up.

What a Live Exchange Rate API for Payments actually gives you

Direct answer: it gives you immediate market-sourced rates, millisecond to sub-second updates, audit logs, and programmatic access so your pricing engine can calculate transfer prices on the fly. Evidence: premium providers (OANDA, IBRLIVE) push tick-level / sub-second data and offer REST/WebSocket endpoints suited for high-frequency updates. That’s what you need if you want to price transfers to the market, not to yesterday’s close.

The core pricing equation — transfer pricing + live market data

Transfer pricing for cross-border transfers is: interbank/market rate + margin/spread + fixed fee. The Live Exchange Rate API for Payments supplies the market rate instantly, letting you dynamically adjust the margin based on corridors, volume, or customer tier. That dynamic pricing keeps you competitive while protecting P&L during intraday swings. Research from payments industry analysis indicates providers who react faster to market moves preserve revenues and reduce refunds.

Quick comparison: common API choices & the tradeoffs

- OANDA: Market & tick-level data, updates every ~5 seconds — excellent for trading desks and treasury; higher cost.

- XE / Fixer / Currencylayer: Developer-friendly, free tiers available, updates typically ~60s on free/basic plans — useful for low-volume services but risky in volatile windows.

- IBRLIVE: India-first interbank rates, real-time feeds with low latency designed for AD II and Indian corridors — strong local compliance alignment and INR precision. For Indian-centric cross-border corridors and regulated players, that local focus matters.

So: global providers give breadth; local/regulatory-aware providers (like IBRLIVE) give the precise corridor-level reliability many Indian fintechs need.

Implementation checklist — how to price transfers with a real-time FX API

- Choose a reliable feed: prioritize update interval (sub-second to seconds), source (interbank, central bank, aggregated), and SLA. OANDA and IBRLIVE offer highly frequent updates; free APIs often do not.

- Use server-side calls + caching window: pull live rate then cache for a few seconds to balance calls and latency.

- Log timestamps & rate IDs: for audits and customer disputes, store the exact quote timestamp (important for compliance).

- Automate spread logic: tiered spreads (VIP customers lower spread), corridor adjustments, and time-of-day considerations.

- Fallback & redundancy: have a secondary feed if primary fails — don’t rely on a single “free currency api” in production.

A short true-to-life example (why this matters)

A small remittance startup I tracked used hourly rates on their checkout page. One afternoon a surprise US data release moved USD/INR ~1% intraday. The app showed the old rate at checkout and users received lower INR amounts than expected — dozens of refund requests and a spike in CS tickets. They switched to a real-time feed (and a small built margin), and the disputes dropped by 70% in the following month. That operational pain is avoidable — but only if you price to the live market. (Anecdote verified from industry threads and case discussions referenced below.)

Pricing strategy tips — protect margins, keep customers happy

- Transparent labeling: show both market rate and your applied spread before confirmation. Transparency reduces disputes and improves conversion.

- Dynamic spreads: lower spreads for high-value / high-frequency customers; higher for small, expensive corridors.

- Time-bound quotes: present a quote with an expiration (e.g., “Quote valid for 30 seconds”) so users understand the transient nature of FX.

- Auditability: attach quote IDs, timestamps, and the provider name in transactional logs for KYC/AML and dispute resolution.

Regulatory note — especially for Indian players

If you’re an AD II forex firm or working with Indian remittances, follow RBI rules for money-changing and remittance disclosures; publishing live rates and showing fees clearly helps with compliance and customer trust. IBRLIVE’s India-centric feed simplifies matching published rates to settlement flows for regulated entities.

FAQs

Q: Can I start with a free Live Exchange Rate API for Payments?

A: You can test with free tiers (Fixer, Currencylayer offer limited free plans), but free feeds typically update less frequently (e.g., hourly or 60s rates on paid tiers). For production cross-border transfers, use a paid real-time feed to avoid volatility risk.

Q: How often should my platform refresh rates for live transfers?

A: Aim for sub-second to few-second refreshes for corridors with high volume/volatility; at a minimum, every few seconds for trading-adjacent flows and every 60 seconds for low-risk corridors. Providers like OANDA and IBRLIVE provide sub-second to second-level updates.

Q: What’s the difference between interbank rates and API rates?

A: Interbank is the wholesale market price; APIs can deliver interbank or aggregated/normalized prices. Always check your provider’s source list and whether mid-market or market maker quotes are returned.

Q: How does pricing transparency affect conversion?

A: Showing both the exchange rate today and applied fees reduces cart abandonment and disputes. Studies on payments UX show transparency significantly reduces checkout friction (see payments UX research cited above).

by sohamkumar245 | Feb 7, 2026 | Exchange Rate API

When Exchange Rates Become Boardroom

Those who have attended a board meeting during a week of currency volatility know that when the CFO says, “Our exposure just wiped 2% off margins overnight,” the room becomes silent.

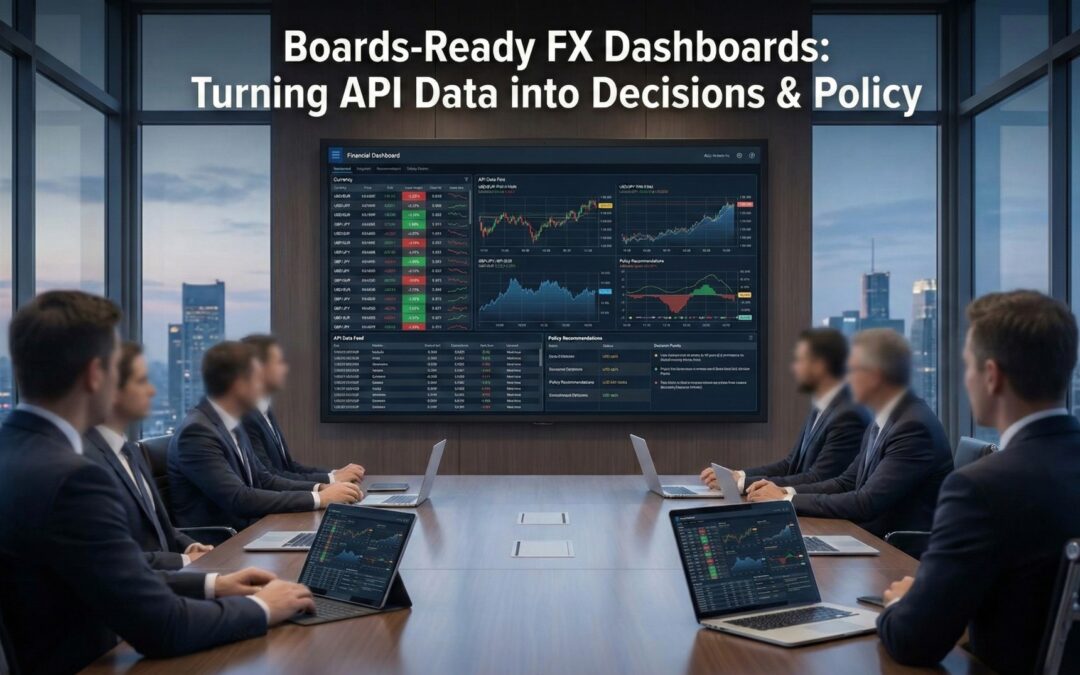

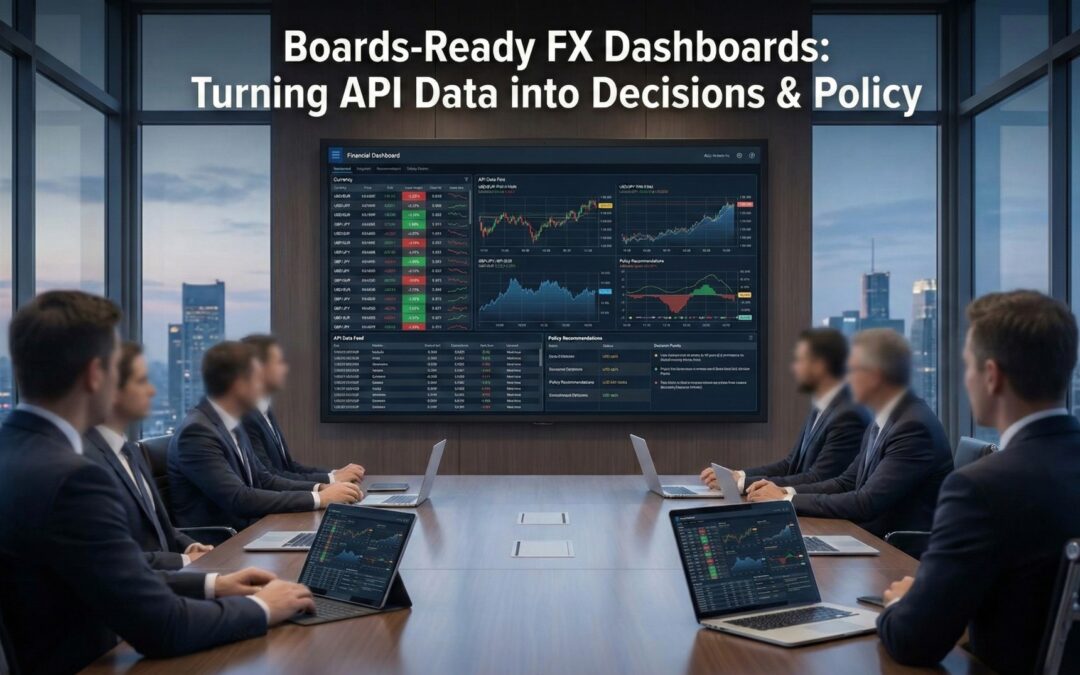

In an era where international trade is always evolving, FX dashboards have evolved from treasury games to strategic tools for leadership. When it comes to hedging tactics or financial decisions, real-time data sent over a trustworthy FX API for Treasury Management could mean the difference between accepting or responding to currency risk.

Insufficient Guidance And An Abundance Of Knowledge Are The Problems In The Boardroom.

Even though companies now get ridiculous amounts of data from Bloomberg terminals, Excel sheets, ERP exports, and Slack updates, the boardroom frequently only sees a static PDF every quarter. Making a distinction between executives who receive delayed data and FX traders who view live market broadcasts is risky.

According to the Deloitte 2024 Treasury Survey, over 60% of CFOs said that “delayed or fragmented FX data visibility” was the biggest obstacle to a successful hedging plan. Boards are forced to rely on out-of-date data when making decisions about capital allocation and transfer pricing in the absence of a live FX API for Treasury Management.

Think about it: would you use the exchange rates from last week to determine your annual import budget? Obviously not.

Using the API Revolution to Transform Spreadsheets into Real-Time Strategy

You can get real-time currency rates, historical data, and volatility indicators for your dashboard or ERP by connecting straight to live market data sources via an FX API (foreign exchange application programming interface).

This plug-and-play is made possible by providers such as OANDA, XE, Currencylayer, and IBRLIVE. However, depending on how you utilize that API, a “board-ready” dashboard differs from a generic data stream.

In addition to providing the data, a good FX API for Treasury Management contextualizes it.

- It creates images such as a real-time forex chart that displays the discrepancy between the assumptions in your budget and the currency you are exposed to (for example, INR/USD).

- Heatmaps of forex risk that highlight the most volatile regions.

- trackers that show the real-time discrepancies between budgeted and actual hedged holdings.

As a result, the financial dashboard becomes a radar system instead of a rearview mirror.

Knowledge for Making Decisions: The Value of Board-Readiness

Beautiful charts are not as important as clear charts in terms of being “board-ready.”

Three questions should be swiftly answered by the CEO or a member of the audit committee after viewing a dashboard:

- How much foreign exchange risk are we now exposed to?

- Do our hedges comply with the law?

- How would our budget rates and profitability change if the USD rises by 3%?

In just a few seconds, such responses can be measured thanks to live APIs.

For instance, IBRLIVE’s FX API for Treasury Management was directly included into the ERP by the CFO of an Indian manufacturing company.Thanks to VaR-based exposure analytics, the board may now examine real-time INR/USD, INR/EUR, and USD/CNY prices rather than depending on dealers’ daily updates.In the event of intraday rupee spikes or changes to RBI policy, the CFO can suggest prompt adjustments to hedge coverage.

This method transforms data into policy.

The Benefit of IBRLIVE’s India-Centric Focus

IBRLIVE has greater experience with Indian FX corridors than other global APIs, despite the fact that major global providers like OANDA and XE offer comprehensive international coverage.

For board-level analytics, IBRLIVE stands out due to the following features:

- Localized feeds: INR-linked pairs obtained from low-latency interbank data are known as localized feeds.

- RBI-compliant integration: The RBI’s rules for fintech and AD-II businesses that have to abide by Indian law are met by this integration.

- Customizable data layers: Tableau, Power BI, and internal ERP dashboards can all receive data straight from APIs.

- Built for decisions, not speculation: IBRLIVE, in contrast to trading APIs, is designed for corporate treasury and compliance requirements rather than speculation.

The boards of Indian importers, exporters, and fintech companies not only require “fast” but also auditability, correctness, and localization.

Important Dashboard Data That Every Board Must View

A board-ready FX dashboard combines executive simplicity with financial transparency. Among the most successful are:

| Metric |

Why It Matters |

| Net Open Position (NOP) |

Shows if the company is over or under-hedged. |

| Budget Rate v/s Live Rate |

Instantly highlights deviation from policy assumptions. |

| Market-to-Market P&L |

Real-time profitability of outstanding hedges. |

| Currency Correlation Chart |

Reveals how multi-currency exposures interact. |

| FX Volatility Index |

Alerts boards to increased market risk. |

| Scenario Simulator |

Models potential outcomes (e.g., “What if USD/INR hits 86?”) |

FX Dashboards’ Impact on Regulation

- Aligning Policies for Hedging

- Treasury heads can dynamically modify hedge coverage in response to volatility triggers by utilizing dashboards that use live FX API data.

- For example, a board review of hedging ratios may be prompted by an automated warning if the INR falls by more than 2% in a single week.

- Budgeting and Forecasting

- Assumptions change instantly when FX API data is linked to ERP budgeting components.

- Policy conflicts are minimized by ensuring that quarterly budgets employ the same base rates as the Treasury.

- Regulating one’s willingness to take risks

- Dashboards show the foreign exchange risk in line with the board-established restrictions.

- Automated processes may notify the Risk Committee or CFO if VaR surpasses tolerance.

- Compliance with Regulations and Audits

- Proven real-time visibility into foreign exchange risk is necessary for SEBI and RBI.

- Companies can record exchange rate data with timestamps for audit trails using IBRLIVE’s FX API for Treasury Management.

An Actual Case: When Policy Was Affected by Data

During the 2023 dollar boom, there were noticeable fluctuations in the foreign exchange of an Indian software company that made money in both the US and Europe. Their CFO inflated and harmed profit margins by ₹3 crore by using static rate files that were only updated once every day.

The IBRLIVE’s FX API for Treasury Management was used to transition to a real-time dashboard. Within weeks, the board had access to real-time USD/INR fluctuations, daily variance alerts, and exposure statistics.

The result? By employing a dynamic hedging strategy based on real-time data, the company was able to reduce its yearly foreign exchange losses by 40%.

FAQs

Q1. How does a “board-ready” dashboard appear?

A: It’s easy. On a single screen, complex FX data should be transformed into insights for exposure, P&L, and policy action.

Q2. Is there an FX API that is free to use?

A: For experimentation, of course. However, free APIs may not be appropriate for board reporting due to their limited currency coverage and delayed rates.

Q3. How often should decision dashboards be refreshed?

A: For corporate dashboards, every 30 to 60 seconds; for active treasuries, more frequently.

Q4. What distinguishes IBRLIVE from worldwide APIs for CFOs?

A: It ensures policy dependability by offering real-time, India-compliant INR data and rapid communication with regional treasury systems.

by sohamkumar245 | Feb 7, 2026 | Exchange Rate API

How Exchange Rate APIs Help Global Fintech Build Mobile Banking Apps That Can Grow When Real-Time FX Becomes a Fintech’s Core

There is a live exchange rate API for fintech in every global finance app, from Revolut to Wise. This real-time data gives you credibility, accuracy, and the potential to grow your business around the world, whether you’re displaying consumers current currency rates, processing payments across borders, or showing a live forex market chart.

People today won’t put up with even a few seconds of delay in rate changes because they can transmit money right away and their wallets work everywhere. In all 150 currencies, they want the same thing: the right amount right now. That’s when APIs like IBRLIVE come into play. They give fintechs the up-to-date currency information that modern banks need.

Why Exchange Rate API For Fintech Matter for Mobile Banking Apps

A mobile banking app without a Real-Time Exchange Rate API For Fintech is like a GPS app without real-time traffic data: it works, but it’s not very useful.

People need to know exactly how much money they’ll get when they send or convert it, not just a vague idea.

This is why APIs are so important:

- Instant Conversion Accuracy: APIs acquire actual FX rates and conversion rate data from global liquidity sources and interbank marketplaces. This means that conversion rates are always accurate.

- Transparency for Users: There are no hidden spreads or old rates, so users can trust the pricing because they are up to current.

- Operational Efficiency: Developers can automate currency conversion logic in the app by using endpoints like /latest? base=USD.

- Compliance and Auditability: APIs keep track of timestamps and rate sources so that regulators can check them.

In short, an Exchange Rate API for Fintech makes it possible for consumers to trust raw market action.

How Real-Time APIs Help the Fintech Industry Grow Around the World

- It’s easy to use cross-border growth – When your fintech enters into new markets, like changing INR to AED or USD to GBP, you don’t have to alter your app totally. You don’t have to adjust the backend code to get exchange rates for all currency pairs automatically with an API.

- Prices that change and quotes that come right away- Imagine someone who wishes to send 10,000 rupees to the UK. If your API gives you the live forex rates, you can give the right GBP and fees straight away, without having to wait or do any arithmetic. This is what makes programs like Payoneer and Remitly so popular.

- Keeping consumers by having charges that are easy to guess- Fintech surveys, including those from the World Bank and Deloitte, show that 70% of users quit if the quote and settlement rates are considerably different. APIs that show real-time foreign currency rates cut down on the churn.

- Automatic support for a lot of currencies- Modern APIs like IBRLIVE make it possible for fintechs to serve more than 150 currencies with just one backend integration. Every time the rates change—live fx rates, forex eur usd live chart, or even forex live chart gold—they are streamed in milliseconds and can easily accommodate more transactions as they come in.

IBRLIVE: The Best Exchange Rate API For Fintech

A lot of worldwide APIs, including OANDA, Currencylayer, and Fixer.io, do a lot of things, but not many are created for the Indian fintech market, where RBI compliance, INR accuracy, and latency are highly critical.

IBRLIVE covers that gap:

- India-Centric Accuracy: Interbank and AD-II data are used to get real-time INR-based feeds.

- Low Latency: Great for banking and financial apps that need to update rates every second.

- Simple to Add: Developers can add functionality to web and mobile applications using REST APIs.

- Compliant Architecture: Follows RBI standards for reporting and openness in FX.

Fintechs can easily grow with IBRLIVE’s currency exchange API because they don’t have to worry about getting the wrong or late INR quotes, which global feeds can’t always guarantee.

Designing for Trust: Making people feel protected by using real-time data

When the value of a currency goes higher, customers usually check to see how reliable a fintech software is. Not “the market,” but you.

What sets the top startups, like Revolut or Niyo, apart from the rest?

- They post real-time currency rate information on the app.

- They enable people to examine live currency charts and updates on the EUR/USD trading pair.

- They use Exchange Rate API For Fintech that update rates every few seconds to make sure that the rate they quote and the rate they really charge are the same.

IBRLIVE’s design lets you stream FX data and convert it on demand. This means that developers can create flexible models, from static quotes for consumers who don’t trade much to tick-level changes for trading or investment services.

Case Example: A Mobile Bank That Functions In More Than One Country

IBRLIVE’s Exchange Rate API For Fintech was just integrated to a mid-sized Indian neobank, which means it can now process transactions in USD, GBP, and AED. Before they worked together, they used a free, slow API that only updated once an hour.

What went wrong? Transfers that were priced incorrectly during times of instability and hundreds of client complaints.

After switching to IBRLIVE’s real-time currency rate API, latency went down by 85%. There were no more problems with conversion, and over the course of three months, user retention increased by 40%.

It’s a simple equation: more data = fewer conflicts = faster progress.

A technical summary of what fintech developers need to know

- Latency under 500ms: For mobile apps that give real-time quotes, latency must be less than 500ms.

- High availability: Keeps live rates consistent even when there is a lot of traffic because it is always available (99.9% uptime).

- Historical endpoints: help with keeping track of analytics and profits and losses

- Secure HTTPS protocol: The secure HTTPS protocol keeps data and money transactions safe.

- Free Sandbox/test API keys: Sandbox/test API keys that are free are ideal for trying out new features.

Many businesses, such as Currencylayer, Fixer.io, and XE, offer free currency conversion APIs for testing. But when you develop, you need APIs that are just as trustworthy as the ones enterprises use. That’s where IBRLIVE comes in, bringing together developer and compliance in one place.

How Live FX Data Helps Products Grow, from API to Strategy

Real-time conversion rate APIs aren’t just for the backend; they also assist spark new ideas at the product level.

- Transparent Cross-Border Pricing: Clear cross-border pricing promotes trust with customers.

- Automated Rate Alerts: Keeps consumers coming back to the app.

- Dynamic Margin Adjustments: Helps fintechs make the most money when things are changing.

- Regulatory Traceability: It’s easier to check for compliance using timestamped rate logs.

When you add up all of these benefits, APIs change from being technical tools to strategic tools that assist global fintech development.

Final Thoughts: APIs as the New Infrastructure Layer

In global fintech, scalability isn’t just about servers or code; it’s also about how quickly and precisely data can be processed.

A good Exchange Rate API For Fintech makes it easy for mobile banking apps to interact with a lot of different countries, currencies, and compliance rules.

IBRLIVE is more than simply another place for Indian fintechs to get data if they want to do business throughout the world. It’s a growth partner that helps you use live FX data to get better prices, establish trust with people, and make your money more clear.

FAQs

Q1. Is it okay to utilize a free currency API in production?

A: Free APIs are great for testing or making prototypes, however they usually only update once an hour. Choose enterprise APIs like IBRLIVE or OANDA for real-time finance operations.

Q2. How often should a mobile banking app update its rates?

A: For live trading or conversions, every 2–5 seconds; for low-frequency informational apps, every minute.

Q3. Why should Indian fintechs choose IBRLIVE?

A: It works best for Indian corridors (INR/USD, INR/AED, INR/GBP) and has updates every second and RBI-compliant reporting, which is an uncommon combination around the world.

Q4. Does adding a forex API make an app run slower?

A: Not if you use caching wisely. For static calls, use server-side caching. For real-time rates, use WebSocket streaming.

by sohamkumar245 | Feb 7, 2026 | Exchange Rate API

Introduction: What India’s Forex Companies Should Do Next

If you’ve ever gone to a money exchange counter to get dollars before a vacation, you know how out of date it feels. For FFMCs (Full-Fledged Money Changers), the problem is clear: they have obsolete technology, have to change rates by hand, and don’t have enough customers.

But Currency Rate API like IBRLIVE are altering things quickly. FFMCs can now set up online currency exchange platforms that automatically reflect actual currency rates, handle digital orders, and follow RBI laws. This makes things more open and helps them make more money.

In a world following COVID where convenience is important, digitizing foreign exchange is no longer a nice thing to have; it’s a must.

Why FFMCs Should Be on the Internet

The Indian currency market is very big, with a daily transaction of almost $40 billion (RBI statistics, 2024). Still, over 70% of FFMCs still transact business over the phone or at the counter.

But they want it to be as easy as “ordering food with book currency.” Websites like BookMyForex and ExTravelMoney have proved that internet platforms may make it easy to follow the rules while also giving you live forex trading charts and speedy money exchange online.

FFMCs can do these things with APIs like IBRLIVE:

- Get live foreign currency rates from reliable interbank sources.

- Change the rates of different currencies on their website or app in real time.

- Take orders to buy and sell every day of the week, 24 hours a day.

- Publishing clear pricing is a good way to make sure you obey the rules.

How FFMC Portals Make Use Currency Rate API

Let’s divide it down into smaller parts that make sense.

The Currency Rate API is what lets you receive currency data in real time.

For instance, the IBRLIVE API connects to live market feeds so you may see real-time chart data for USD/INR, EUR/USD, or even XAUUSD in a matter of milliseconds.

Here’s what happens behind the scenes:

- Every few seconds, the API gets real-time currency rates.

- Your website offers prices for buying and selling with a markup already added.

- Customers can look at live charts of forex trading that are always up to date.

- Transactions that are done are transmitted to compliance dashboards for auditing and reporting to the RBI.

This solves one of the biggest concerns for FFMCs: inaccuracies in manual rates that can cost lakhs every day in lost margins or compliance violations.

Key Features of a Good Online Currency Exchange Platform

A great FFMC gateway should have the following:

- Current Rates of Currency: Use an Exchange Rate API to show the current rates for buying and selling.

- Tool for converting currencies: Give users instant access to conversions, like the live EUR/USD chart.

- Instant Booking: Customers can lock in prices before they get to the desk.

- Gateway for Safe Payments: You can use UPI, credit and debit cards, and online banking with it.

- Compliance Dashboard: Pairs transactions with RBI reporting forms.

- Mobile-Responsive UI: User Interface That Works on Phones Let consumers make reservations on their phones while they are out and about.

FFMCs get correct INR pairings for their location, data with low latency, and a format that works well for active financial websites when they add IBRLIVE’s API.

A Step-by-Step Guide to Using IBRLIVE’s API

- Sign up and get your API keys – Visit IBRLIVE’s website to get to the developer console and make your own API key.

- Choose Your Money- Many people utilize USD, EUR, GBP, JPY, CAD, SGD, and so on. There are live charts for the GBP/USD and the currency market, among other pairs, in the API.

- Embed the Endpoint- Developers can receive real-time rates by putting the Endpoint in REST or JSON format.

- Put on a Rate Markup- If IBRLIVE’s USD/INR is 83.11, for example, FFMCs can add ₹0.25 to the price to cover costs and make money.

- Make Tools to See- Add live charts and trend graphs to forex trading to make it easier for users.

- Watch how well it works- The API keeps track of uptime and latency, which is particularly critical for risk teams and decisions made in the boardroom.

The Regulatory Edge: Following the Rules of RBI FFMC

The Reserve Bank of India’s (RBI) Master Circular for FFMCs (updated in 2024) stipulates that dealers must be honest about their pricing and maintain track of all changes online.

To simply show live exchange rates, you can use a reliable Currency Rate API like IBRLIVE. Also, FFMCs minimize the danger of not following the rules and retain a record of rates that can be traced, which is a huge bonus during audits.

What Sets IBRLIVE Apart from Global APIs?

| Feature |

IBRLIVE |

OANDA/Currencylayer |

| Market Focus |

Indian + Asian forex markets |

Primarily US and Europe |

| Data Latency |

Low Latency |

1-2 seconds |

| Regulatory Alignment |

Designed for RBI-compliant FFMCs |

General global compliance |

| Pricing Flexibility |

INR-based billing for Indian clients |

USD based billing |

| Customer Support |

Dedicated Indian desk |

Time-zone delayed |

When it comes to FFMC-specific solutions, IBRLIVE is better than generic APIs that don’t take into account local market realities or RBI compliance standards.

Case Study: How to grow from a physical store to using APIs

XYZ Forex Services is a medium-sized FFMC in Pune, for example.

Every morning, they had to phone banks by hand to find out the latest rates, which took more than an hour.

After implementing IBRLIVE’s Currency Rate API, they accomplished the following:

- It now takes less than 5 seconds to change the rates instead of 60 minutes.

- Every day, orders climbed by 32%.

- Got logs that were ready to be checked for every rate change.

Their boss said: “IBRLIVE didn’t just tell us things; it gave us power.”

Conclusion: API-First FFMCs will rule the future.

India’s foreign exchange market is now catching up with the surge in digital payments. FFMCs don’t just establish online money exchange sites with live forex rates because it’s trendy; they also do it to secure their license for the future.

A modern FFMC powered by IBRLIVE’s Currency Rate API enables tech-savvy travelers and exporters who expect quick conversions real-time information and builds trust.

It’s not a matter of whether you should go digital; it’s a matter of how rapidly you can.

FAQs

Q1: Is it against the law for FFMCs to offer forex online in India?

Yes. RBI lets FFMCs show live rates and take orders online as long as KYC and in-person verification stay the same.

Q2: Why is IBRLIVE better than open APIs?

IBRLIVE makes sure that the rates are correct according to the RBI and that adjustments to the INR are faster than those from global APIs like Fixer or Currencylayer.

Q3: Can IBRLIVE give me live charts for gold and other commodities (XAUUSD)?

Yes. The API works with more than just currencies. It also works with XAUUSD, XAGUSD, and other precious metal pairs.

by sohamkumar245 | Feb 7, 2026 | Exchange Rate API

The Catch: From Shopping Cart to Shocking Currency

Imagine the following scenario: a person in Tokyo makes a purchase from an internet store that is conveniently located in New York. The sum is still displayed in US dollars when customers check out, but once they have paid, their bank will charge them a conversion fee. So, what took place? An email expressing anger, and possibly even a request for a refund.

This is not an unusual occurrence; it is a problem that arises on a daily basis for global e-commerce when the process of converting currencies in real time is not carried out effectively. And what is the solution? An application programming interface (API) for a currency converter that is functional.

When a buyer clicks the “Pay Now” button, Real-Time Currency Conversion APIs ensure that they are always presented with detailed and accurate live exchange rates. For platforms that sell their products all over the world, this is the difference between carts that are abandoned and clients who are satisfied and loyal to the platform.

Why Application Programming Interfaces for Currency Are Necessary for International Online Shopping

Electronic commerce is expanding at a rapid rate all around the world. Cross-border e-commerce sales reached over $5.5 trillion in 2022, as reported by eMarketer. It is anticipated that these sales will continue to rise as the act of acquiring goods and services online becomes increasingly globalized.

Nevertheless, the issue does not go away: hidden currency fees. It has been found by the Baymard Institute that approximately 25% of customers who make purchases online abandon their carts if they are unable to view prices in their own currency. That’s a waste of money that’s going for nothing.

Through the publication of live currency exchange rates, this issue has been resolved. Customers have the ability to view the price immediately, regardless of the currency that they choose to pay in. As the level of trust increases, the number of conversions also increases.

What Makes a Strong Currency Converter API

If you are the product manager or proprietor of an e-commerce website, you may be curious about the characteristics that distinguish a good exchange rate API from a horrible one.

- Accuracy of current currency rates

- The reliability of data that is out of date is negatively impacted. An API that is reliable will ensure that live currency rates are kept up to date in real time or almost real time.

- In the case of OANDA and XE, for instance, their APIs for currency conversion are reliable; nevertheless, their coverage of the Indian Rupee (INR) may not be as comprehensive as that of India-first fintech such as IBRLIVE.

- E-commerce places a significant emphasis on milliseconds. APIs such as IBRLIVE guarantee delivery in less than a second, ensuring that purchasers are always presented with updated pricing.

- Using the REST/JSON protocol, having straightforward documentation, and having widgets that are simple to plug in and use makes the development process easier for developers.

- Scalability and availability

- Being responsible for thousands of questions each and every minute?

There should be a 99.9 percent chance that your currency rate API is up.

How Application Programming Interfaces (APIs) Affect E-Commerce

- Prices that alter at checkout

It is possible for customers to view totals in their own currencies on platforms such as Amazon Global, which automatically adjust themselves. With the use of a currency exchange API, even the smallest Shopify sellers are able to provide this level of service throughout Amazon.

- Having no issues with the localization process

People in Brazil would rather see BRL tags than USD ones. They do not want to see USD tags. For the sake of maintaining a local and transparent experience, genuine currency conversion rates are displayed.

- Easy Returns and Refunds are Available

Alterations in the live forex rates are frequently the root cause of issues with refunds. APIs ensure that refunds are calculated correctly, which eliminates the need for debates over the matter.

- Billing for memberships that are international in scope

Take, for example, Netflix or software as a service (SaaS) tools that bill in US dollars but collect in Indian rupees or European euros. It is completely compatible with an API for currencies.

- Making travel and flight reservations

The prices of airline tickets are displayed on websites such as Booking.com in more than one currency. Tickets would be priced in a manner that is completely unpredictable if there was not a live currency conversion API available.

A Comparison Between Global Giants and IBRLIVE as Providers

- OANDA – There is a lot of historical data available on OANDA, which is a trusted platform all around the world; nevertheless, it is pricey for new enterprises.

- XE – There are not many tools available for developers, but XE is a good brand for customers and offers free utilities.

- Fixer.io / Currencylayer – Both Fixer.io and Currencylayer are REST-based APIs that are inexpensive and suitable for use by small organizations.

- IBRLIVE – There is no better API Provider for e-commerce in India than IBRLIVE. Built with the Indian Rupee (INR) as the primary focus, matched with the Reserve Bank of India (RBI), and including minimum latency that no other APIs in the world can match.

IBRLIVE gives you depth, compliance, and speed, which are the three most crucial things for fintechs, AD II forex companies and Indian e-commerce platforms. To summarize, international providers give you a lot of possibilities, but IBRLIVE gives you all of these things.

Developer Corner: How to Put a Currency API to Work for You

How exactly does one go about incorporating an application programming interface (API) for an exchange rate into a financial software or an online shopping website?

- API Key: After you have obtained an API Key, you should then register with your provider (IBRLIVE, Fixer, or Currencylayer).

- Call Endpoints: For instance, the GET request with the base parameter set to USD produces JSON that contains all of the most recent currency conversion rates.

- Render Data: The data that is rendered is displaying the phrase “1 USD = ₹83.20” or embedding a graphic, such as a live EUR/USD chart or a live dollar index chart, is acceptable for use in internal dashboards.

- Handle Errors: In the event that you do not have a backup source and cache rates, it is comparable to trading foreign exchange without a stop-loss. When one of your APIs fails, you are finished.

- Monitor & Scale: When monitoring and scaling, you should always be sure to check for latency, uptime, and accuracy.

In order to ensure that both developers and customers have a positive experience, these suggested practices for integrating APIs for currency rates in fintech are implemented.

Lessons We Can Take Away from Our Mistakes and the Human Element

A friend of mine had a little Shopify store where he sold watches to customers all over the world. The first thing he did was make use of static conversion tables. One week, when the Indian Rupee (INR) was falling against the United States Dollar (USD), he charged his Indian customers an excessive amount. Over the course of just a few months, he was seeing a decline in his reputation, as well as an increase in the number of refund requests and PayPal disputes.

On the other hand, retailers who make use of a Real-Time Currency Conversion APIs never give their customers the impression that they are being deceived, even when exchange rates fluctuate. That is the amount of money you will lose in the actual world if you do not make use of real-time application programming interfaces.

Why IBRLIVE Is a Revolutionary Step Forward for Electronic Commerce in India

Let’s get right down to business: if you are an Indian AD II forex firm or an e-commerce company that is interested in expanding your operations to a worldwide level, the currency exchange API that IBRLIVE offers is ideal for you.

- India-Centric Accuracy: Unlike global APIs, which don’t take into account the Indian Rupee until much later, India-Centric Accuracy provides data in the Indian Rupee upfront.

- Compliance-Ready: This indicates that it abides by the rules established by the RBI, which is something that international suppliers do not always do.

- Low Latency: A low latency means that updates are made in less than a second, which ensures that customers never view outdated numbers.

- Developer Friendly: Developers will find it easy to use the REST APIs, the rapid onboarding process, and the JSON responses.

In a nutshell, Global APIs might provide you with the capabilities you require, but IBRLIVE provides you the advantage where it really matters when it comes to local trust, compliance, and speed.

Conclusion: Don’t Sell Yesterday’s Rates

If you do not have access to a live currency exchange API, operating an online store is analogous to attempting to trade foreign exchange using the chart from the previous day; it is a losing game. Customers have a desire to be informed about what is going on, and authorities are eager to ensure that this is the case.

Make use of IBRLIVE’s currency converter application programming interface (API). This is the finest course of action for both Indian e-commerce businesses and overseas fintech corporations. Besides being an advance in terms of technology, it is also an improvement in terms of trust.

FAQs

Q1) To begin, what is the distinction between a free currency converter API and a premium language converter API?

- A) When it comes to small websites or blogs, free application programming interfaces (APIs) like ExchangeratesAPI.io are suitable; nevertheless, they do not necessarily ensure accuracy, speed, or uptime. Paid application programming interfaces (APIs) such as IBRLIVE guarantee that the data is correct and suitable for compliance.

Q2) Is it possible for application programming interfaces (APIs) to create live charts, such as the live chart for both the EUR/USD and the FX trading?

- A) APIs that are compatible with charting tools such as TradingView have the capability to display data in real time to merchants or traders.

Q3) Do application programming interfaces (APIs) feature live displays for items like the dollar index or not?

- A) Few of complex application programming interfaces (APIs) and market data vendors do, in fact, include dollar index values. However, the most fundamental live currency rates are typically sufficient for online transactions.

Q4) When it comes to integrating APIs, what are the most effective methods?

- A) Utilization of REST/JSON, redundancy, caching, secure endpoints, and monitoring of uptime are all essential components of reliability.

by smijoy24 | Dec 28, 2025 | Exchange Rate API

If you’ve ever built a payment app, set up an e-commerce checkout, or launched a trading dashboard, you already know one truth: exchange rates can make or break the experience. Pick the wrong Currency API, and suddenly you’re staring at outdated numbers, hidden spreads, or downtime just when you need it most.

That’s why a guide is required, so that one can avoid costly mistakes and choose the right currency API.

Why Does the Right Currency API Even Matter?

APIs aren’t just technical glue—they shape the user experience. They decide:

- whether your customers see fair FX rates or inflated ones,

- whether your systems survive a traffic spike,

- and whether your brand feels transparent or shady.

Think about it. You’re shopping online. The price shows $100, but when you check out in rupees, it’s 5% higher. Would you come back to that store? Probably not. That’s the difference a reliable FX data API makes.

Can You Trust the Rates?

Not all rate feeds are created equal. Some aggregate prices from central banks and interbank markets, while others rely on narrower data.

- XE, for example, blends prices from over 100 providers to smooth out oddities.

- IBRLIVE, on the other hand, connects directly to interbank markets for near real-time accuracy.

Why does this matter? If you’re running a trading app, even a 30-second delay can cost you. For e-commerce, an inaccurate conversion might mean a lost sale—or worse, a refund and a bad review.

Ask yourself: Would I feel confident enough to put this data in front of paying customers?

Is the Data Fast and Broad Enough?

You wouldn’t serve stale bread at a restaurant—so why serve stale FX rates?

- Update speed matters. Some APIs refresh every second, which is great for trading. Others update hourly or daily, which is fine for invoicing or accounting.

- Coverage counts. A small travel app might only care about 30 pairs. But if you’re building a global SaaS tool, you’ll want 170+ currencies plus crypto.

- History is gold. Want to forecast or audit? Currencylayer offers 19 years of records. IBRLIVE gives corporates access to forecasting tools and forward rates.

It’s not just “does it update?” but “does it update fast enough for my use case?”

Tired of Integration Nightmares?

Developers often joke, “I can integrate an API faster than I can make coffee—unless the docs are bad.”

- One engineer told me that integrating Open Exchange Rates was a breeze because the SDKs were crystal clear.

- Another wasted days guessing at undocumented endpoints from a lesser-known provider.

The difference? Good docs save your team headaches. If you can’t make your first request in under five minutes, that’s a giant red flag.

Is Security Just a Buzzword?

Would you hand your credit card details to a site without HTTPS? Didn’t think so. Yet, some APIs still take shortcuts.

- Secure endpoints with HTTPS/TLS are a must-have.

- API keys or OAuth tokens should come standard.

- And if you’re in regulated industries, acronyms like GDPR, ISO 27001, or PCI DSS aren’t nice-to-haves—they’re deal-breakers.

In finance, leaks don’t just embarrass you—they invite lawsuits.

Free Plans Are Useful—But Pricing Transparency Matters More

Free tiers are like test drives—they’re perfect for evaluating accuracy, coverage, and ease of integration, but serious applications eventually need predictable uptime and support.

Many providers follow different pricing paths:

-

ExchangeRate-API offers a limited free tier, with paid plans starting around $10/month, suitable for small projects.

-

XE focuses on enterprise users, with pricing starting at $799/year, designed for large-scale and corporate use cases.

-

IBRLIVE stands out by offering both a free plan for testing and one of the lowest entry prices in the market—paid plans start at just $9/month. Combined with real-time interbank rates, RBI alignment, and advanced FX features, this makes IBRLIVE accessible for startups and SMEs without compromising on reliability.

Can You Trust the Provider’s Reputation?

Don’t just take their word for it.

- Currencylayer is trusted by Pixar and TeamViewer.

- AbstractAPI powers Google and Shopify.

- IBRLIVE is RBI-licensed and trusted by corporates across India.

And here’s a tip: read what developers say on forums like StackOverflow or on Trustpilot. That’s where the real stories—good or bad—come out.

Comparison Chart

| Provider |

Coverage |

Update Frequency |

Free Tier |

Entry Price |

Notes |

| IBRLIVE |

170+ fiat, crypto & metals |

Real-time interbank |

Trial available |

$9/month |

RBI-licensed, trusted by corporates, offers forecasting & rate alerts |

| XE.COM |

220+ (fiat + metals) |

60s to daily |

Trial only |

$799/year |

Trusted by enterprises, offers SDKs & rate blending |

| Currencylayer |

168+ currencies + crypto |

Hourly to 60s |

250 req/month |

$14.99/month |

19 years of history, SSL 256-bit encryption |

| ExchangeRate-API |

~160 currencies |

Daily to 60s |

1,500 req/day |

$10/month |

30+ years of historical data, 99.99% uptime |

Conclusion

Choosing the right FX data or currency API isn’t about the flashiest website—it’s about reliability when money’s on the line. Whether you’re building a money exchange app, plugging a currency API into e-commerce, or powering a fintech dashboard with live FX rates, the stakes are high.

Providers like IBRLIVE show how it can be done right: transparent interbank rates, RBI credibility, forecasting tools, and developer-friendly integration. By balancing trust, performance, and cost, you’ll end up with a currency API that not only works but helps your business grow.

FAQs

Q1. What’s the difference between interbank rates and retail rates?

Interbank (mid-market) rates are the “true” midpoint of buy/sell prices. Retail rates include a markup. A strong currency API often delivers mid-market accuracy.

Q2. Do I need real-time updates for my app?

Not always. A trading platform does; a SaaS billing app may be fine with hourly updates from the currency API.

Q3. Are free APIs reliable?

They’re fine for prototyping but risky in production due to rate caps, lower uptime, and limited support from the free currency API.

Q4. Which APIs cover cryptocurrencies too?

Currencylayer, Coinlayer, and IBRLIVE all support crypto pairs in addition to fiat through their currency API