The Unseen Foundation of the Fintech Industry

You know how bad it is to have wrong forex data if you’ve ever seen a trading program freeze while the USDINR live rate jumps.

A Reliable Exchange Rate API keeps track of the latest quotes, charts, and margins for every smooth payment gateway, trading interface, and wallet transfer.

People notice when it breaks, and fintech companies have trouble with rules, refunds, and their reputation.

It’s easy to ask: Which APIs can fintechs really trust to give them accurate, up-to-date currency data in a market where milliseconds and decimals matter?

Why It’s Important to Get the Right Forex Information

According to McKinsey’s 2023 Global Payments Report, more than 60% of fintech revenue comes from transactions that happen across borders or in foreign currencies.

So, when real-time exchange rates are wrong, they not only annoy customers but also hurt whole business models.

For example, a payment system that says the US dollar is worth ₹82.10 when it is actually worth ₹83.05. The 95-paise difference could make it hard for brokers and merchants who do thousands of transactions to make money.

So, a Reliable Exchange Rate API needs to be accurate, have low latency, and be up all the time.

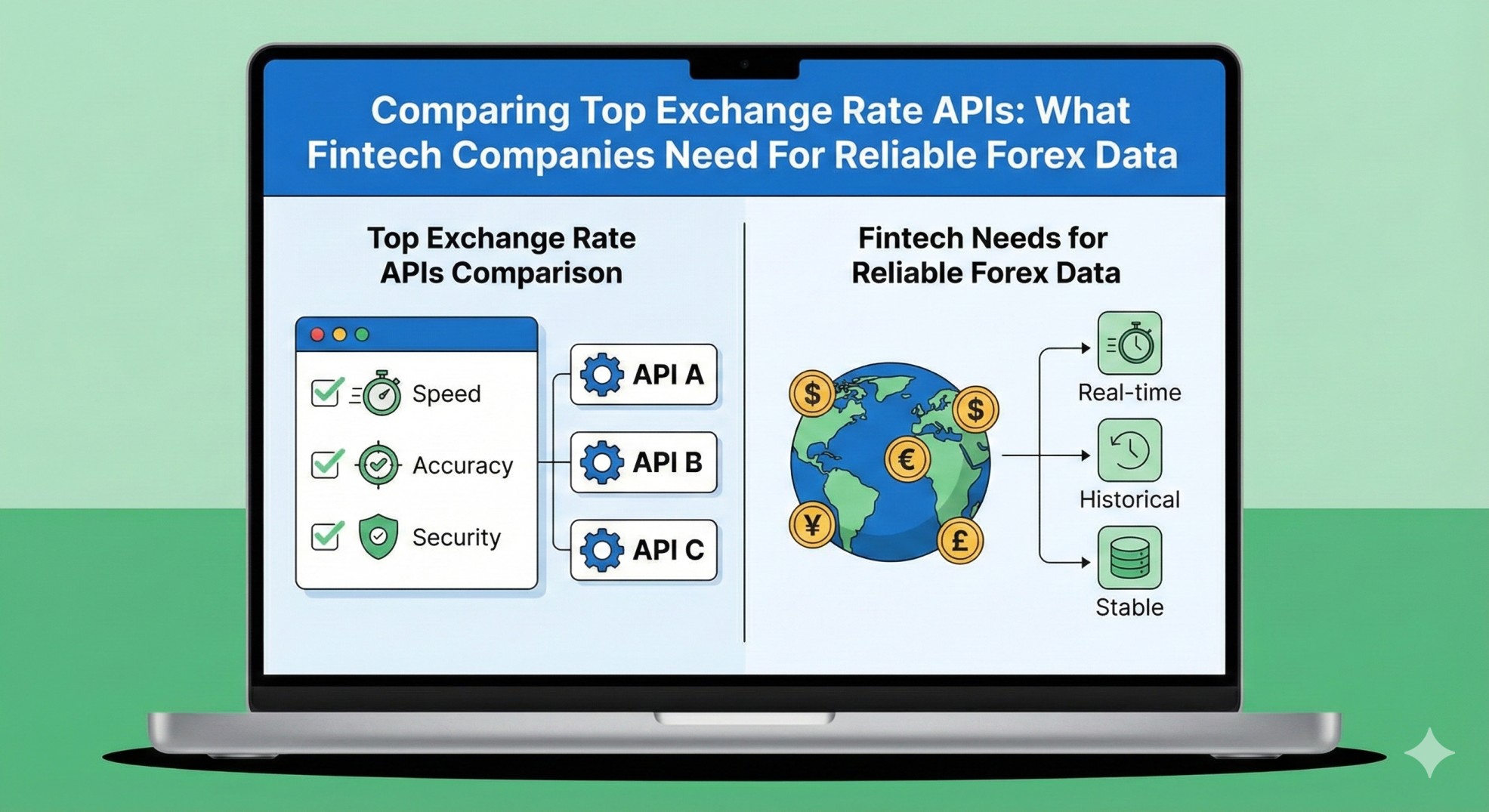

What Are the Best Features of a Reliable Exchange Rate API?

- Accuracy and Refresh Speed: Updates every few seconds or so using data from central banks or interbank sources.

- Coverage: There are at least 150 currencies covered, and some of them are very rare.

- Reliability: servers that have 99.9% uptime and are redundant.

- Ease of Integration: Sandbox testing, REST/JSON replies, and clear documentation make integration easier.

- Localisation and Compliance: Following rules like those set by the FCA in the UK or the RBI in India is what compliance and localization mean.

Fintech teams usually use these five things to figure out if an API is a long-term partner or just a short-term problem.

Comparison Among the Top Exchange-Rate APIs

| Provider | Currencies | Update Frequencies | Free Plan | Ideal Use Case | Stand-Out Feature |

| OANDA | 200+ | ~5 seconds | No | Trading, treasury desks | Tick-level historical data + robust analytics |

| XE | 170+ | ~60 seconds | Yes | E-commerce, travel | Consumer-trusted rates & simple widgets |

| Fixer.io | 170+ | ~60 seconds | Yes | Developers, SMEs | Straightforward REST API & SSL |

| Cuurencylayer | 160+ | ~60 seconds | Yes | SaaS, startups | Easy onboarding, historical data |

| IBRLIVE | Global + INR-First | Real time (<1 second) | Limited | Indian fintechs, AD II forex firms | RBI-aligned data, sub-second latency, local compliance |

Global Benchmarks: Currencylayer, Fixer, XE, and OANDA.

- OANDA is an expert in trading infrastructure and has a lot of historical data for quant models and live forex trading charts. It costs more and takes longer to develop the middle ground.

- XE is great for apps that need live currency rates on websites or travel apps, but its API updates are slower.

- Developers like Fixer.io and Currencylayer because they have free tiers and fast REST connections. But their INR accuracy usually depends on feeds from other sources instead of government rules.

All of these are great choices around the world, but none of them were made with India’s latency or compliance needs in mind.

What Makes IBRLIVE Different: Its Local Edge

IBRLIVE meets that need by making India’s first Reliable Exchange Rate API available to everyone around the world.

More and more Indian payment gateways, CRMs, and AD II FX companies are choosing it for the following reasons:

- INR Precision: Prices come straight from reliable market sources and Indian retailers that have been given permission to sell.

- Latency is low: Its data pushes every second are very helpful for live dashboards and trading live chart interfaces.

- Regulatory Alignment: Follows the rules set by the RBI, which makes it easier for licensed businesses to do the same.

- Scalable infrastructure: Scalable infrastructure is a must for finance apps that get a lot of traffic because it can handle thousands of API calls at once.

IBRLIVE is better than OANDA when it comes to immediacy and localization, which are two important things for businesses that send real money in Indian rupees.

The Secret Cost of “Free” APIs

A lot of businesses start with a free currency API, but when the market changes, they find out what’s wrong.

Think about a small money transfer app that you could find on Reddit in the r/fintech section. The developers used a free currency conversion API plan that was updated once an hour. On Friday night, shocking US inflation data sent the USDINR through the roof. The app said that the dollar rate today live was ₹81.90, but it was actually ₹83.00. In less than an hour, 200 customers said their purchases had only been partially credited. They lost money on refunds because of the “free” deals and got a bad rating on the Play Store.

Having old information about money is worse than not having any at all.

Case Study: Trader’s Curse and Latency

“In fast markets, five seconds feels like five decades,” one trader said. He wasn’t going too far. When the NFP (Non-Farm Payrolls) numbers come out, spreads get bigger and prices go up by a few points every tick. In short, trading blind apps get real-time FX values every minute instead of every second.

Professional systems stream tick-by-tick feeds for this reason. Retail fintech companies that can’t afford Bloomberg terminals can use APIs like IBRLIVE or OANDA to make their systems more reliable for less money.

Developer Considerations

In addition to the marketing brochures, teams that use these APIs also need the following:

- API Structure: REST/JSON calls like /latest?base=USD return simple key-value pairs for all major pairings.

- Error Handling: Store audit timestamps and fallback rates in a cache.

- Security: Always use HTTPS and API-key authentication because currency data is still financial data.

- Scalability: Keep an eye on the call limits so that the service doesn’t slow down when more people use it.

- Testing: Check the results against feeds from TradingView or Investing.com to be sure they are right.

Not paying attention to any of them will raise your risk without you knowing it, just like leaving an open trade overnight without a stop-loss.

A Fintech Look at IBRLIVE Compared to Other Points of View

For fintech companies that want to work with people in India and other countries:

- Payment Gateways: IBRLIVE works with settlement systems to show official live dollar rates and INR quotes during the checkout process.

- CRMs/ERPs: Companies can use real-time FX widgets to show data about the currency market on their dashboards in real time.

- Trading Startups: With INR rates that change every second, it’s possible to make accurate EUR/USD live chart overlays without having to rely on other people.

- Regulated AD II Firms: Data sources that follow RBI rules help keep audit surprises to a minimum.

IBRLIVE is basically a promise, which is something that free or generic APIs don’t usually do.

Conclusion: Real Time is the Real Edge

Fintech now uses APIs in the same way that trading floors used ticker tapes.

Slow or old feeds are a sure way to lose customers and pip value, just like trading yesterday’s newspaper.

XE and OANDA are still good choices for people all over the world.

Fintech companies that do business in or are connected to India can use IBRLIVE’s Reliable Exchange Rate API to get the right balance of speed, compliance, and INR-centric accuracy. For any big player, all three of these things are important.

Using real-time data can help you stay ahead of the market instead of just keeping up with it.

FAQs

Q1: Which API for exchange rates is the most reliable & accurate for real-time conversions?

A: OANDA and IBRLIVE both offer data from the market that is almost real-time. IBRLIVE, on the other hand, has better coverage of the Indian rupee and the Asian time zone.

Q2: How often do APIs change the dollar or USDINR rates in real time?

A: Free plans usually take a minute or more to update, but premium APIs do it every second or faster.

Q3: Are there reliable, free currency exchange APIs that entrepreneurs can use?

A: Both Fixer.io and Currencylayer have free tiers, but they aren’t very big. They are good for testing, but not for banking apps that people use in real life.

Q4: Why is IBRLIVE a good choice for Indian fintech businesses?

A: It is the best local fit for regulated businesses because it has low latency, INR data that is in line with RBI standards, and a simple REST interface.