The global market is continuously expanding, and businesses are finding new opportunities to trade beyond their national borders. Exporting is an essential aspect of business growth, and maintaining a healthy cash flow is vital for businesses to succeed in this domain. In the world of international trade, export invoice factoring is a financial solution that can help exporters overcome cash flow challenges. In this blog, we will discuss the concept of export invoice factoring, its process, and the benefits it offers to exporters.

What is Export Invoice Factoring?

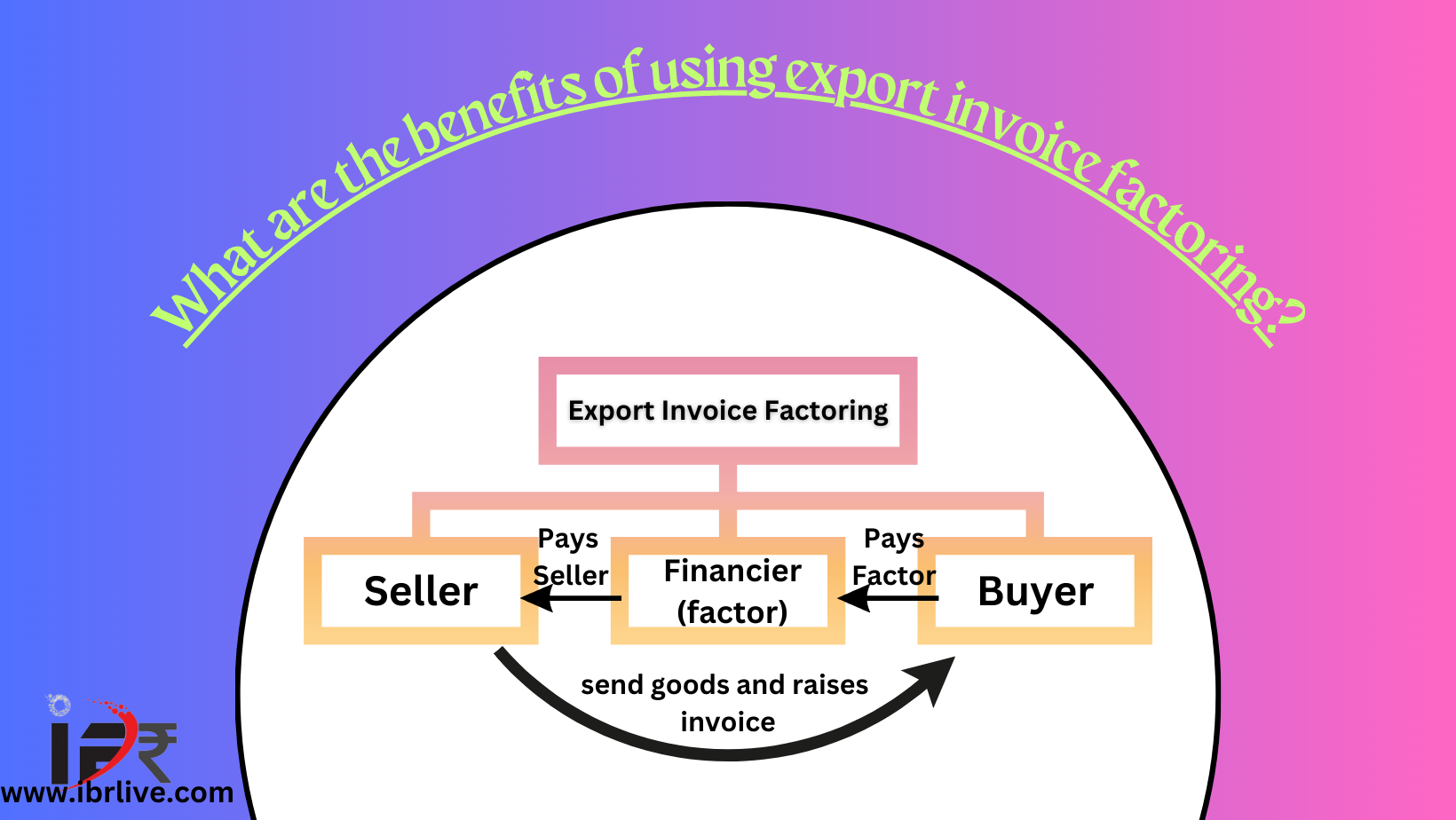

Export invoice factoring is a financial solution that allows exporters to sell their outstanding invoices or accounts receivable to a factoring company, also known as a factor. The factor, in turn, advances a percentage of the invoice amount to the exporter, typically around 80-90%, within a short time frame. Once the customer pays the invoice, the factoring company settles the remaining balance with the exporter, minus their fees.

The Process of Export Invoice Factoring

- Export and invoicing: The exporter ships the goods to the overseas buyer and issues an invoice with a due date for payment.

- Assigning the invoice: The exporter assigns the invoice to the factoring company and provides them with the necessary documentation, such as the invoice, shipping documents, and proof of delivery.

- Advance payment: The factoring company verifies the submitted documents and, once approved, advances a percentage of the invoice value to the exporter.

- Collection: The factoring company takes on the responsibility of collecting the payment from the overseas buyer on the due date.

- Settlement: Once the buyer pays the invoice, the factoring company settles the remaining balance with the exporter, minus their fees.

Benefits of Export Invoice Factoring for Exporters - Improved cash flow: By receiving advance payments on their outstanding invoices, exporters can improve their cash flow and use the funds to fulfill new orders, pay suppliers, and cover operational expenses.

- Credit risk management: Factoring companies often provide credit assessment and monitoring services, helping exporters minimize the risk of non-payment from their overseas buyers.

- Access to working capital: Export invoice factoring allows exporters to access working capital without taking on additional debt, providing them with the flexibility to grow their business.

- Faster payment: Since factoring companies advance payments, exporters can receive funds quickly, usually within a few days, as opposed to waiting for weeks or months for their customers to pay.

- Professional collections: The factoring company handles the collections process, saving exporters time and effort in chasing overdue payments and navigating foreign legal systems.

- Currency risk management: Factoring companies often provide currency risk management services, allowing exporters to lock in exchange rates and minimize the impact of currency fluctuations on their profits.

Name of a few companies involved in export invoice factoring:

State Bank of India (SBI) Global Factors Limited:

A subsidiary of the State Bank of India, SBI Global Factors Limited provides a range of factoring services, including export invoice factoring, for small and medium-sized enterprises.

ECGC Limited (formerly Export Credit Guarantee Corporation of India Ltd.):

ECGC Limited offers export factoring services, along with export credit insurance and guarantees, to support Indian exporters.

Drip Capital:

It’s a fintech company providing trade finance solutions to small and medium-sized enterprises (SMEs) involved in cross-border trade. Founded in 2015, Drip Capital focuses primarily on exporters from emerging markets, including India. The company offers export invoice factoring services, enabling businesses to access working capital by selling their accounts receivable to Drip Capital.

IBRLIVE INDIA PVT LTD:

IBRLive bridges the gap between exporters and reliable factoring companies, streamlining the factoring process to help businesses unlock their growth potential. Our expertise ensures seamless financing solutions, enabling exporters to focus on expanding their global footprint.

Conclusion

Export invoice factoring is a valuable financial tool that can help exporters overcome cash flow challenges and grow their business in the international market. By partnering with a reliable factoring company, exporters can unlock the potential of their export business and focus on expanding their global footprint.