by ibrlive | Feb 16, 2024 | Blog

Meaning of FDI:

FDI is a procedure whereby the citizen of one nation buys the right to manage the production and other operations of an organization in another (host country).

Regarding FDI

Foreign Direct Investment (FDI) is the word used to describe the transfer of money in the kind of long-term investments from one nation to another. It takes place when an investor creates a long-term position in a foreign company by purchasing a controlling interest or starting a new venture. Developing nations like India rely on FDI to expand and flourish because it delivers not only finance but also technology, managerial know-how, and access to new markets.

For instance, the USA will make investments in the Indian company while India serves as the home country. Therefore, FDI refers to an American company investing in an Indian business.

Kinds of FDI

- Horizontal FDI: In this type of FDI, money is invested internationally in the same sector. In other words, a business may invest in a foreign firm that manufactures comparable goods. For example, a US board company, Nike, might buy Puma, a firm with headquarters in Germany.

- Vertical FDI: an organization invests in a foreign company that it might sell to or supply as part of a supply chain, rather than immediately in the same industry.

- Conglomerate FDI: With this sort of FDI, a purchase is undertaken in a completely unrelated sector of the economy. It has no immediate connection to the investor’s company. For example, a US store might buy stock in the German automaker BMW.

How can an Indian company receive foreign investment?

For FDI to enter India, there are two entrance points: the Automatic Route and the Government Route.

- Automatic method: Under this method, investments in shares of equity, entirely and obligatory converted bonds, or completely and obligatory converted preferred stock of an Indian company do not need the government of India’s consent.

- Governmental Route: Foreign investments in particular industries and endeavors must receive prior government authorization in India. The relevant Administrative Ministry/Department evaluates proposals. If an Indian firm with foreign investment has been founded and isn’t controlled or owned by a local entity, government authorization is required.

b. By fusion, merger, demerger, or acquisition, control of an existing Indian firm that is controlled or owned by resident Indian people or Indian companies is being given to a non-resident entity.

c. The ownership of an existing Indian company, owned or controlled by resident Indian citizens or Indian companies, is being transferred to a non-resident entity through amalgamation, merger, demerger, or acquisition.

The entities which can invite FDI in India:

- Indian Companies: They can issue capital against FDI.

- Partnership Firms/Proprietary Concerns: NRIs can invest under certain conditions, while other non-residents need prior approval from the Reserve Bank. Certain restrictions apply to investments in agricultural, plantation, real estate, and print media businesses.

- Trusts: FDI is not permitted, except in Venture Capital Funds (VCF) regulated by SEBI and ‘Investment vehicles’.

- Limited Liability Partnerships (LLPs): Foreign investment is allowed under specific conditions and compliance with the LLP Act, 2008.

- Investment Vehicles: Entities regulated by SEBI or other designated authorities, including REITs, InvITs, and AIFs, are permitted to receive foreign investment subject to specific terms and conditions.

- Startup Companies: Startups can issue equity, equity-linked instruments, debt instruments, or convertible notes to foreign investors, subject to certain conditions and regulations.

Prohibited Sectors for FDI in India

While the Indian government has liberalized its FDI to encourage foreign investment in most sectors, there are certain areas where investments by non-residents are prohibited. These include:

- Lottery businesses, including government/private lottery and online lotteries.

- Gambling and betting activities, such as casinos.

- Cheque money.

- Nidhi businesses.

- Transferable development rights (TDRs) trading.

- Farmhouse construction or real estate businesses. This restriction does not apply to the development of townships, the building of homes or businesses, the building of roads or bridges, or the creation of Real Estate Investment Trusts (REITs) that are registered and subject to regulation by the SEBI (REITs) Regulations, 2014.

- Manufacturing tobacco goods, such as cigars, pipes, cheroots, cigarillos, and nicotine replacement products.

- Sectors or activities that are off-limits to investments from the private sector, such as the railway industry and atomic energy.

- Any type of foreign technological partnership, including franchising, trademark, brand name, or management contract licensing in connection with lotteries, gaming, or betting operations.

Documents required for FDI approval in India:

- Certificate of incorporation

- Memorandum of Association(MOA)

- Board Resolution

- Audited financial statement of last financial year

- Article of association

Importance of FDI in India

- Economic growth: FDI is a vital source of capital for India’s economic growth. It supplements domestic capital, enables infrastructure development, and fuels industrialization.

- Employment generation: FDI helps create job opportunities by establishing new businesses, expanding existing ones, and increasing production capacities.

- Technological advancement: FDI brings state-of-the-art technology and expertise, promoting innovation and competitiveness in the Indian market.

- Access to global markets: FDI allows Indian businesses to integrate with global supply chains, fostering the export of goods and services.

- Balance of payments: FDI inflows help improve India’s balance of payments, strengthening the country’s foreign exchange reserves.

FDI policy 2020:

As of April 2020, the government has received over 120 FDI proposals worth Rs. 12000 crore from China. India received the highest-ever total FDI inflow of $ 81.72 billion during the financial year 2020-2021 and it is 10% higher as compared to the last financial year 2019-2020 worth US$ 74.39 billion.

Holding and subsidiary company:

Holding company:-A company that purchases 51% of shares that company is known as a holding company (host country)

The subsidiary company:-A company that sales its shares as its shares are purchased by another company is called the subsidiary company

Two ways of FDI:

- Foreign companies purchase shares or debentures of the Indian company and invest in the Indian company

- The foreign company comes to India and establishes its own company in India

Examples of FDI in India:

- Google picked up 7.73% of Reliance’s JIO platform for USD 4.5 Billion it is one of the biggest deals in India’s corporate fundraising session.

- General Atlantic, one of New York’s most equity USD 900 million for a picket in reliance’s JIO platform in JUNE 2020.

The following rules apply to the issuing and exchange of shares under the FDI policy:

- Capital instruments must be issued 60 days after the inward remittance is received. The money shall be returned within 15 days following the 60-day period if they are not issued within that time limit. Non-compliance results in a violation of FEMA, which is punishable.

- The issue price for shares should follow certain rules:

a. SEBI’s rules for listed businesses

b. A fair valuation for unlisted companies by a Chartered Accountant or Merchant Banker registered with SEBI.

c. The Reserve Bank of India pricing rules for preferred allocation

3. Following RBI regulations, Indian enterprises that are permitted to distribute shares to outsiders may keep the subscription money in an overseas bank account.

4. Shares and convertible debt transfers:

- General approval is provided for the transfer of shares, subject to particular criteria and requirements, and non-resident investors may invest in Indian enterprises by purchasing/acquiring existing shares, according to the FDI sectoral policy.

- The AD Category-I Bank must receive Form FC-TRS following sixty days of the date of the transfer of funds or receipt/remittance of monies, whichever comes first.

- Sale consideration must undergo a KYC check by the remittance receiving AD Category-I bank.

- Non-resident investors, including NRIs, who hold control by SEBI regulations, can acquire shares of a listed Indian company on the stock exchange.

- Escrow accounts can be opened and maintained by AD Category-I banks without prior RBI approval, subject to terms and conditions.

- Deferred payment for share transfer between resident and non-resident is allowed up to 25% of total consideration, not exceeding 18 months from the transfer agreement date. Escrow arrangements or indemnity provisions can be made within these limits. The total consideration must comply with applicable pricing guidelines.

Remittance and restoration of sales profits guidelines:

- Remittance of sale proceeds, remittance upon winding up, and company liquidation:

- Are governed by FEMA’s 2000 Foreign Exchange Management (Remittance of Assets) Regulations.

- Provided the security has been held on a repatriation basis, the sale complies with established rules, and a NOC/tax clearance certificate from the Income Tax Department is produced, AD Category-I banks may permit the transfer of sale proceeds to sellers who reside outside of India.

- Remittance on winding up/liquidation of companies is allowed by AD Category-I banks, subject to payment of applicable taxes and submission of required documents, including a tax clearance certificate, auditor’s certificates, and confirmation of no pending legal proceedings.

- Dividend repatriation is allowed without restriction (net of any appropriate tax deductions made at the source or payment of dividend taxes).

- Interest repatriation is unrestricted (net of any applicable taxes) for completely, mandatorily, and compulsorily convertible debentures.

Reporting Requirements:

All the necessary reporting must be completed using the Single Master Form (SMF) accessible on the Foreign Investment Reporting and Management System (FIRMS) platform at https://firms.rbi.org.in. The guide for reporting can be found at https://firms.rbi.org.in/firms/faces/pages/login.xhtml.

Still have queries you may contact us here

by ibrlive | Feb 16, 2024 | Blog

Interest Equalization Scheme:

The Interest Equalization Scheme was first announced on 1st April 2015 by the Government of India to provide pre- and post-shipment Rupee export credit to eligible exporters. It is also known as interest subvention. A rebate of interest is provided to exporters on RPC/EPC and FBILL limits. Under this scheme, exporters can claim a reimbursement from the Reserve Bank of India.

Qualification for the Interest Equalization Program

To benefit from this program, the exporter must make the goods by the definition of “manufacture” under the FTP. The following exporters are eligible for the Interest Equalization Scheme:

- Exporters of goods from manufacturers who come under the designated 416 four-digit tariff line.

- All exporters of Micro, Small, and Medium-Sized Enterprises (MSMEs);

- Merchant exporters who fall under the defined 416 four-digit tariff line;

- All exporters of Micro, Small, and Medium-Sized Enterprises (MSMEs) and Merchant Exporters who come under the defined 416 four-digit tariff lines have been included in this program as of January 2, 2019.

Note: This program does not apply to merchant exporters outside the 416 tariff lines.

Benefits of Interest Equalization Scheme for export credit

- Provide international identification to the export sectors.

- Helps in increasing export competition

- Provide pre-and post-shipment export credit to exporters at a lower rate to the eligible exporters

- Enhance export performance

- Help exporters by providing credit to grow their business which results in increased exports.

Rate of Interest Equalization

- The scheme’s initial implementation, which lasted for five years starting on April 1, 2015, used an equalization rate of 3% annually. The Scheme may be changed or amended at any moment by the Government.

- The Indian government agreed to raise the interest equalization rate between 3% to 5% on November 2, 2018.

- The Indian government agreed to add merchant exporters as well on January 2, 2019. They are eligible for interest equalization at a rate of 3% on credit for the export of goods covered by the 416 tariff lines designated under the Interest Equalisation Scheme for Pre- and Post-Shipment Rupee Export Credit, which is still in effect.

- The circular states that the Indian government has prolonged the Interest Equalisation Scheme from April 1, 2020, through March 31, 2021, with identical scope and coverage.

- By RBI Circular No. 2021-22/21 dated April 12, 2021, the Government of India has extended the Interest Equalisation Scheme for pre- and post-shipment Rupee export credit for three more months, or till June 30, 2021, with the same scope and coverage.

- According to RBI Circular No. RBI/2021-22/65, issued July 1, 2021, the Indian government has prolonged the Interest Equalisation Scheme for an additional three months, up to September 30, 2021, with unchanged scope and coverage.

- According to Circular No. RBI/2021-22/180 dated 08.03.2022, the Government of India granted the extension of the Interest Equalisation Scheme for Pre- and Post-Shipment Rupee Exports The credit is through March 31, 2024, or until further review, whichever is earlier. However, the interest subvention has been reduced from 5% to 3%. The additional period begins on the first of October 2021 and lasts until March 31, 2024.

Below is a list of the most recent changes the Government has made to the Scheme.

- The “Telecom Instruments” sector, which has six HS lines1, would not be able to use the Scheme, except for MSME manufacturer exporters.

- Beneficiaries who are receiving benefits under another government Production Linked Incentive (PLI) program are not eligible for the expanded Scheme.

- Between October 1, 2021, and March 31, 2022, banks must identify the eligible exporters by the Scheme, credit the accounts with the allowable amount of interest equalisation, and submit an industry-specific consolidated reimbursement claim to the Reserve Bank by 30 April 2022.

- Beginning on April 1 of 2022, banks must cut the interest rate they charge eligible exporters ahead of the regulations and submit the original claims within 15 days of the end of the relevant month, stamped with the bank’s seal and verified by an authorised individual, in the format specified.

- After excluding 6 HS lines in the telecom sector, the prevailing interest subvention rate is 3% for MSME manufacturer exporters exporting under any HS lines and 2% for manufacturer and merchant exporters exporting under 410 HS lines.

- Most significantly, to qualify for upfront interest subvention beginning on April 1, 2022, every exporter must get a UIN from the DGFT and submit it to their banks.

The recently launched digital IT module for the Interest Equalisation Scheme’s UIN/UDIN generation process involves:

Effective 01.04.2022, a Unique IES (Interest Equalisation scheme) Identification Number (UIN) must be provided to the relevant bank to receive Interest Equalisation against pre- and post-shipment rupee export credit applications.

Steps for applying UDIN

- First, register on the DGFT Website https://dgft.gov.in. The applicant IEC is linked to its online account, IEC (ANF-2A) and Exporter-Importer Profile (ANF-1) is updated to reflect the correct and latest details.

- Login with registered credentials navigate to services > Interest Equalization Scheme> apply for Interest Equalization Scheme and fill in the required details.

- Rs.200 is to be paid online for UIN.

- An acknowledgement containing UIN would be auto-generated when the completed application is submitted online.

- An SMS and email intimation of UIN will be sent to a registered email account and mobile number of the exporter.

- After UIN generation, no changes will be allowed. The exporter has to generate a new UIN for correcting the application.

- Exporter has to submit UIN to their concerned bank for getting the benefit of IES.

- UIN has a validity of 1 year from the date of registration it is valid on all pre- and post-shipment credits availed till 31.03.2023.

by ibrlive | Feb 16, 2024 | Blog

Are you planning to study in Canada?

We have fantastic news for you! ICICI Bank Canada and Royal Bank of Canada (RBC) have joined forces to provide an unparalleled banking experience tailored to the needs of international students. By opening a student GIC account with ICICI Bank Canada and linking it to an RBC account, you gain access to a range of exclusive benefits and offers that will make your financial journey in Canada effortless and rewarding.

RBC Student Banking Features: Get More with Your Student Account

When you open a student account with RBC, you unlock a range of exclusive features designed to meet your banking needs. Here’s a glimpse of the benefits you can enjoy:

- Up to CAD 2,000 Credit Card Limit: Even without a credit history, you can get an RBC credit card with a limit of up to CAD 2,000 when you bank with RBC.

- RBC Mobile App: Seamlessly manage your finances with the RBC Mobile app, which offers digital tools to help you make smart money decisions. Enjoy features like virtual Visa Debit for secure online banking, the convenience of “Tap & Pay” with your mobile device, free monthly statements, and online/mobile banking.

- Extensive Branch and ATM Network: Access over 1,200 branches and 4,200+ ATMs across Canada, ensuring convenient banking wherever you are.

CAD 100 Cashback Offer: Make the Most of Your Student GIC Account

We’re excited to share an additional benefit! When you open a student account with ICICI Bank through IBRLive, you’ll also receive CAD 100 cashback instantly. This cashback can be a great boost to your finances as you embark on your educational journey in Canada.

ICICI Bank Canada Advantage: Easy and Convenient Student GIC Account

Students from India can benefit from several benefits from ICICI Bank Canada. Here are some good reasons to open a student GIC account with ICICI Bank Canada:

- Simple and Quick Account Setup: Apply from the convenience of your home to promptly open a fee-free account. The application process is convenient and easy to use online.

- Low Processing Fees: At CAD 150, ICICI Bank Canada has one of the lowest fees for processing, ensuring affordable account opening.

- Fastest GIC Issuance: ICICI Bank Canada has an impressive turnaround time for GIC issuance, ranging from 3 hours to 1 working day, once your account is funded.

- Convenient Refund Process: In case of visa rejection or other reasons, ICICI Bank Canada provides a convenient online refund process, ensuring a hassle-free experience.

Step-by-Step Guide to Opening a Student GIC Account

To help you get started with the ICICI Bank Canada Student GIC Program, follow these simple steps:

- Step 1 (in India): Start by completing the ICICI Bank Canada application form online. Provide your passport and proof of enrollment for verification. Upon submission, you’ll instantly receive an account number. Do not forget to fulfill the referral information given below to claim your $50 cash back and share the screenshot at contact@ibrlive.com. For any help and query, you may call us at 9991622344. Please note that this cashback is provided by IBRLIVE INDIA PVT LTD and not by ICICI Bank.

![]()

- Step 2 (in India): Fund your account through a wire transfer with a minimum deposit of CAD 10,175. This includes CAD 10,000 for your Student Account, CAD 150 for the account processing fee, and CAD 25 for any applicable bank charges.

- Step 3 (Upon arrival in Canada): Activate your account with RBC to access your funds in Canada. Download the ‘ICICI Bank Canada SPP’ app and complete the activation form, including your new Canadian phone number and address. Select the activation through the RBC option and upload your passport and study permit. RBC will send you a confirmation email with instructions to meet an RBC Advisor and open your RBC account.

Remember to complete the online activation form before visiting a participating RBC branch. Bring your passport, study permit, and permanent account number (PAN) to the appointment.

Dedicated Support for Students

We understand that you may have questions throughout the process. That’s why ICICI Bank Canada has a dedicated team of Relationship Managers based in India ready to assist you. They will address your queries and ensure a smooth experience from start to finish.

Open Your Student GIC Account Today!

Open a student GIC account with ICICI Bank Canada and link it to an RBC account to get your academic career in Canada off to a good start. Take advantage of the effortless banking experience, special deals, and committed support offered by these two reliable companies. Visit our web page or get in touch with our specialized email support line for students for additional details and to get started.

Disclaimer: This statement is subject to the terms and conditions of the partnership between ICICI Bank Canada and RBC. Please visit each organization’s website for detailed information and qualifying requirements. This blog post’s information was correct when it was written, but it could have changed since then.

by ibrlive | Oct 9, 2023 | Blog

The global market is continuously expanding, and businesses are finding new opportunities to trade beyond their national borders. Exporting is an essential aspect of business growth, and maintaining a healthy cash flow is vital for businesses to succeed in this domain. In the world of international trade, export invoice factoring is a financial solution that can help exporters overcome cash flow challenges. In this blog, we will discuss the concept of export invoice factoring, its process, and the benefits it offers to exporters.

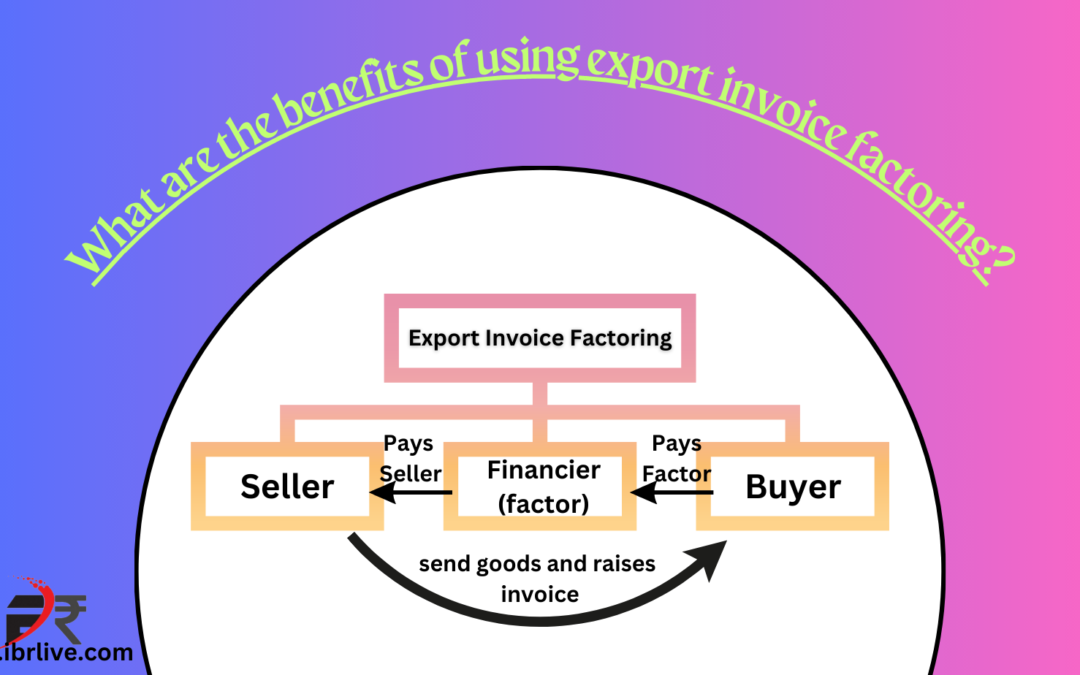

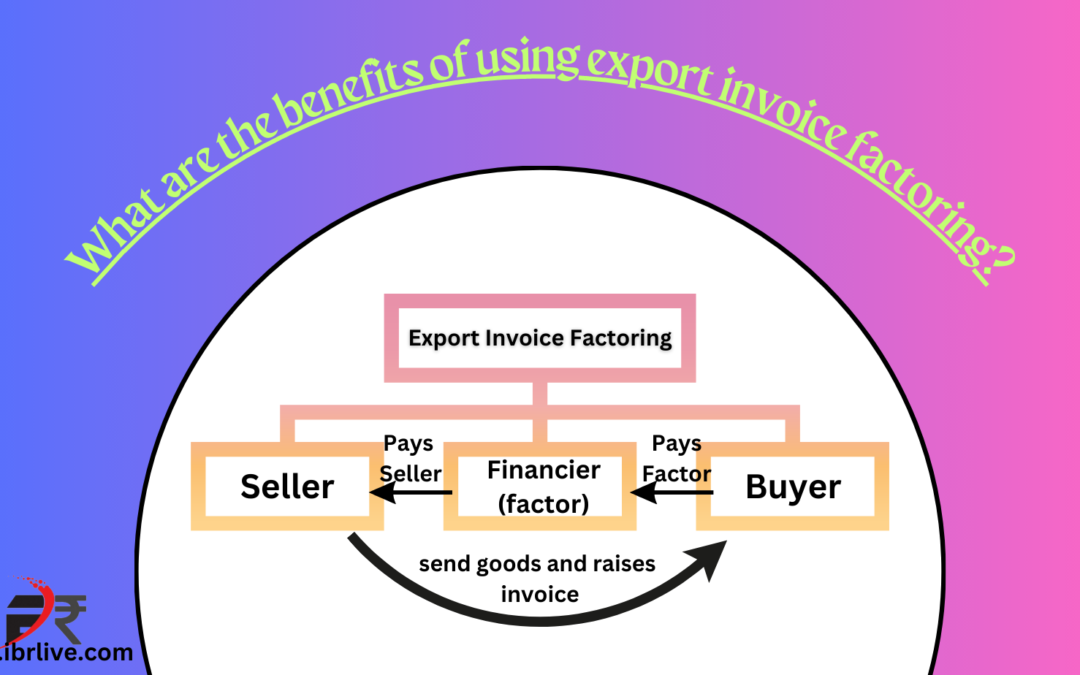

What is Export Invoice Factoring?

Export invoice factoring is a financial solution that allows exporters to sell their outstanding invoices or accounts receivable to a factoring company, also known as a factor. The factor, in turn, advances a percentage of the invoice amount to the exporter, typically around 80-90%, within a short time frame. Once the customer pays the invoice, the factoring company settles the remaining balance with the exporter, minus their fees.

The Process of Export Invoice Factoring

- Export and invoicing: The exporter ships the goods to the overseas buyer and issues an invoice with a due date for payment.

- Assigning the invoice: The exporter assigns the invoice to the factoring company and provides them with the necessary documentation, such as the invoice, shipping documents, and proof of delivery.

- Advance payment: The factoring company verifies the submitted documents and, once approved, advances a percentage of the invoice value to the exporter.

- Collection: The factoring company takes on the responsibility of collecting the payment from the overseas buyer on the due date.

- Settlement: Once the buyer pays the invoice, the factoring company settles the remaining balance with the exporter, minus their fees.

Benefits of Export Invoice Factoring for Exporters

- Improved cash flow: By receiving advance payments on their outstanding invoices, exporters can improve their cash flow and use the funds to fulfill new orders, pay suppliers, and cover operational expenses.

- Credit risk management: Factoring companies often provide credit assessment and monitoring services, helping exporters minimize the risk of non-payment from their overseas buyers.

- Access to working capital: Export invoice factoring allows exporters to access working capital without taking on additional debt, providing them with the flexibility to grow their business.

- Faster payment: Since factoring companies advance payments, exporters can receive funds quickly, usually within a few days, as opposed to waiting for weeks or months for their customers to pay.

- Professional collections: The factoring company handles the collections process, saving exporters time and effort in chasing overdue payments and navigating foreign legal systems.

- Currency risk management: Factoring companies often provide currency risk management services, allowing exporters to lock in exchange rates and minimize the impact of currency fluctuations on their profits.

Name of a few companies involved in export invoice factoring:

State Bank of India (SBI) Global Factors Limited:

A subsidiary of the State Bank of India, SBI Global Factors Limited provides a range of factoring services, including export invoice factoring, for small and medium-sized enterprises.

ECGC Limited (formerly Export Credit Guarantee Corporation of India Ltd.):

ECGC Limited offers export factoring services, along with export credit insurance and guarantees, to support Indian exporters.

Drip Capital:

It’s a fintech company providing trade finance solutions to small and medium-sized enterprises (SMEs) involved in cross-border trade. Founded in 2015, Drip Capital focuses primarily on exporters from emerging markets, including India. The company offers export invoice factoring services, enabling businesses to access working capital by selling their accounts receivable to Drip Capital.

IBRLIVE INDIA PVT LTD:

IBRLive bridges the gap between exporters and reliable factoring companies, streamlining the factoring process to help businesses unlock their growth potential. Our expertise ensures seamless financing solutions, enabling exporters to focus on expanding their global footprint.

Conclusion

Export invoice factoring is a valuable financial tool that can help exporters overcome cash flow challenges and grow their business in the international market. By partnering with a reliable factoring company, exporters can unlock the potential of their export business and focus on expanding their global footprint.

by ibrlive | Oct 9, 2023 | Blog

TCS Slab on Foreign Remittances: Impact on Overseas Investments and the Money Remittance Industry

Outward foreign remittances from India have seen steady growth in recent years. As per available data, outward remittances stood at approximately USD 18,760.69 million in FY21 and increased to USD 19,610.77 million in FY22. However, this trend is expected to slow down following changes introduced under the Finance Act 2023, which significantly revised the TCS slab applicable to foreign remittances under the Liberalised Remittance Scheme (LRS).

Earlier, most foreign remittances attracted a 5% Tax Collected at Source (TCS). Under the revised framework, the TCS slab has been increased to 20% for several categories of overseas spending. Although the implementation date was initially set for July 1, 2023, it was later extended to October 2023 to allow taxpayers and businesses additional time to comply. The primary objective of revising the TCS slab is to improve monitoring of high-value foreign remittances, enhance tax compliance, strengthen foreign exchange reserves, and curb illicit financial flows.

What Is the New TCS Slab Under LRS?

The TCS slab under LRS refers to the tax collected by authorised dealers at the time an Indian resident sends money abroad for specified purposes. Under the revised rules, a 20% TCS applies to most foreign remittances, including overseas investments and international travel expenses, with specific exemptions provided for education and medical purposes.

While the tax collected can be adjusted against the final income tax liability, the higher upfront deduction significantly impacts liquidity and financial planning for individuals and businesses.

How the Revised TCS Slab Impacts Foreign Remittances

The revised TCS slab applies to a wide range of foreign remittances, including:

-

International travel expenses

-

Overseas investments

-

Purchase of foreign currency

-

Remittances for non-essential purposes

However, remittances made for education and medical treatment abroad remain outside the higher 20% TCS slab, subject to prescribed conditions.

This change directly affects the money remittance industry, as service providers must update their systems to calculate, collect, and report higher TCS amounts. In addition, customers must be educated about the revised tax implications to avoid confusion and dissatisfaction.

Impact of the TCS Slab on Overseas Investments

Under the revised TCS slab, investments in foreign stocks, mutual funds, cryptocurrency, and overseas property attract a flat 20% TCS. Even though certain institutions offering overseas exchange-traded funds or international mutual fund exposure may not fall directly under the remittance framework, the overall attractiveness of overseas investments reduces due to the higher upfront tax burden.

Industry experts have pointed out that this change could discourage retail participation in international markets. Commenting on the impact, Zerodha’s co-founder Nithin Kamath noted that higher TCS would adversely affect platforms offering international stock investments and crypto exposure, making overseas diversification less viable for many investors.

Effect of the TCS Slab on International Travel and Tour Packages

The revised TCS slab also significantly impacts international travel. Individuals purchasing foreign currency, loading travel cards, or booking international tour packages through domestic travel portals are subject to 20% TCS. While the base cost of tour packages remains unchanged, the overall expense increases due to the higher tax collection.

However, business travel expenses borne directly by employers or tickets purchased independently may not attract TCS, depending on the transaction structure. Despite this, the higher tax rate is expected to discourage discretionary overseas travel and shift consumer preference toward domestic tourism.

Challenges for the Money Remittance Industry

The implementation of the revised TCS slab presents operational and compliance challenges for the money remittance industry. Service providers must:

-

Upgrade systems to handle higher TCS calculations

-

Ensure accurate reporting and reconciliation

-

Address customer concerns regarding increased costs

One of the major concerns raised relates to credit card spending abroad. The lack of a consolidated mechanism to track overseas spending across multiple cards has created ambiguity around enforcement. Experts have suggested self-declaration and stronger monitoring frameworks to ensure accurate TCS collection.

Ajay Rotti, founder of Tax Compass, highlighted this issue by pointing out that applying TCS on international credit card usage could adversely affect business travellers who incur expenses on behalf of their employers, without serving any meaningful compliance objective.

Government’s Objective Behind Revising the TCS Slab

Despite concerns, the government maintains that the revised TCS slab is aimed at ensuring greater transparency and accountability in foreign remittances. By increasing the upfront tax collection, authorities seek to discourage excessive overseas spending, improve tracking of high-value transactions, and promote domestic investment and consumption.

The move also aligns with broader economic goals, including strengthening India’s foreign exchange position and enhancing long-term tax revenue without directly increasing income tax rates.

Exemption of Credit Card Spending and Future Outlook

The government’s decision to exempt international credit card spending from the LRS limit and TCS deduction has provided temporary relief to taxpayers. However, it remains unclear whether this exemption will continue in the long term. As payment infrastructure evolves, authorities may revisit the applicability of the TCS slab on overseas card transactions.

Taxpayers and businesses involved in foreign remittances must stay informed about future amendments to avoid compliance risks and unexpected costs.

How Businesses Can Adapt to the Revised TCS Slab

Although the higher TCS slab poses challenges, businesses involved in foreign remittances and travel services can adapt strategically:

Update systems and educate customers

Service providers should upgrade internal systems and proactively communicate changes to customers to build trust and reduce friction.

Focus on exempted categories

By facilitating remittances for education and medical purposes, businesses can offset some of the decline in discretionary overseas spending.

Offer value-added services

Providing compliance support, financial planning assistance, and documentation guidance can help businesses differentiate themselves.

Promote domestic tourism

Tour operators can shift focus toward domestic travel by curating attractive local experiences and partnering with regional tourism bodies.

Innovate and explore new markets

Leveraging technology, fintech partnerships, and niche customer segments can open new revenue opportunities despite regulatory changes.

Conclusion: Understanding the Long-Term Impact of the TCS Slab

The introduction of the revised TCS slab on foreign remittances marks a significant shift in India’s approach to monitoring overseas financial transactions. While the higher tax rate impacts individuals, overseas investments, and the money remittance industry, exemptions for education and medical expenses provide partial relief.

Adapting to the new framework requires awareness, planning, and strategic adjustments. With informed decision-making and compliance-focused solutions, both individuals and businesses can navigate the evolving foreign remittance landscape effectively.