by sohamkumar245 | Feb 7, 2026 | Blog

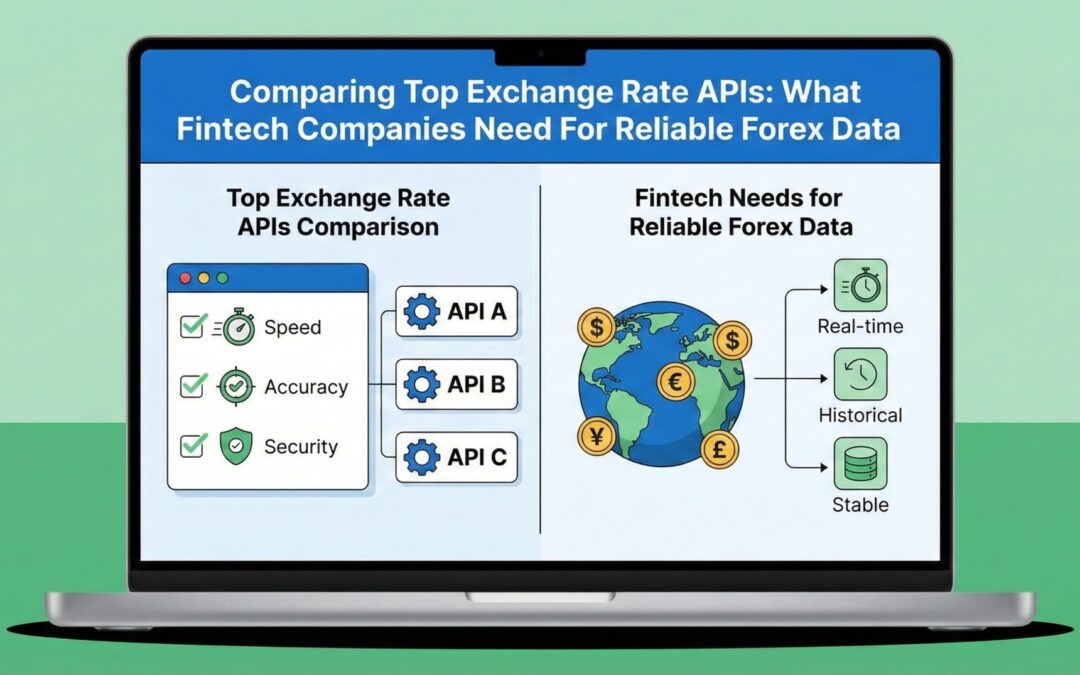

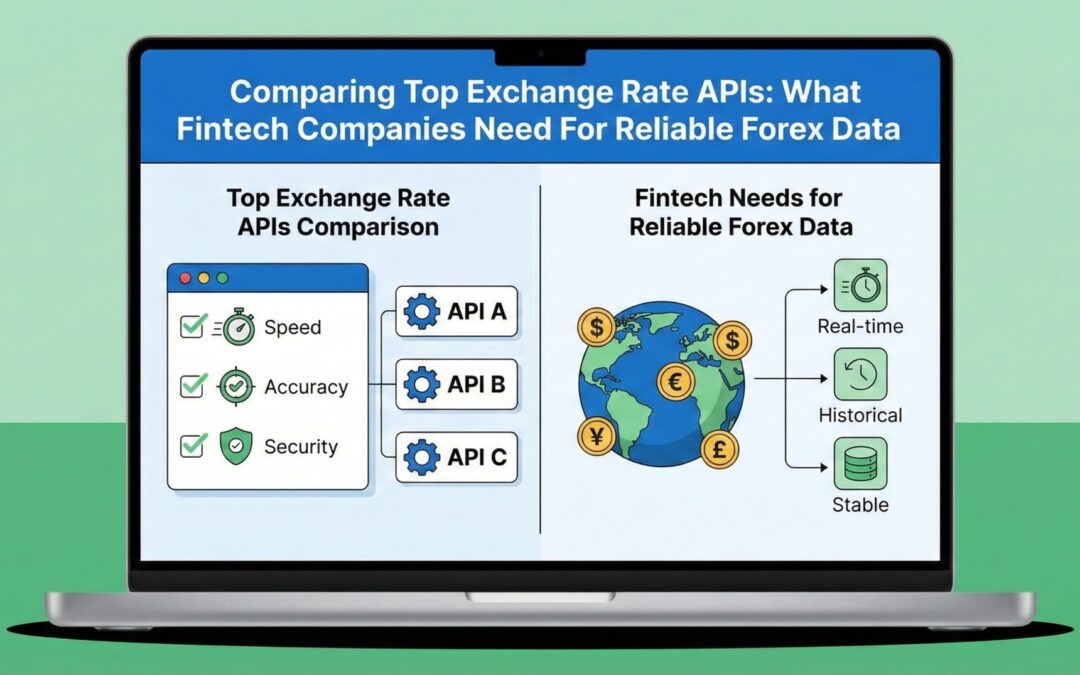

The Unseen Foundation of the Fintech Industry

You know how bad it is to have wrong forex data if you’ve ever seen a trading program freeze while the USDINR live rate jumps.

A Reliable Exchange Rate API keeps track of the latest quotes, charts, and margins for every smooth payment gateway, trading interface, and wallet transfer.

People notice when it breaks, and fintech companies have trouble with rules, refunds, and their reputation.

It’s easy to ask: Which APIs can fintechs really trust to give them accurate, up-to-date currency data in a market where milliseconds and decimals matter?

Why It’s Important to Get the Right Forex Information

According to McKinsey’s 2023 Global Payments Report, more than 60% of fintech revenue comes from transactions that happen across borders or in foreign currencies.

So, when real-time exchange rates are wrong, they not only annoy customers but also hurt whole business models.

For example, a payment system that says the US dollar is worth ₹82.10 when it is actually worth ₹83.05. The 95-paise difference could make it hard for brokers and merchants who do thousands of transactions to make money.

So, a Reliable Exchange Rate API needs to be accurate, have low latency, and be up all the time.

What Are the Best Features of a Reliable Exchange Rate API?

- Accuracy and Refresh Speed: Updates every few seconds or so using data from central banks or interbank sources.

- Coverage: There are at least 150 currencies covered, and some of them are very rare.

- Reliability: servers that have 99.9% uptime and are redundant.

- Ease of Integration: Sandbox testing, REST/JSON replies, and clear documentation make integration easier.

- Localisation and Compliance: Following rules like those set by the FCA in the UK or the RBI in India is what compliance and localization mean.

Fintech teams usually use these five things to figure out if an API is a long-term partner or just a short-term problem.

Comparison Among the Top Exchange-Rate APIs

| Provider |

Currencies |

Update Frequencies |

Free Plan |

Ideal Use Case |

Stand-Out Feature |

| OANDA |

200+ |

~5 seconds |

No |

Trading, treasury desks |

Tick-level historical data + robust analytics |

| XE |

170+ |

~60 seconds |

Yes |

E-commerce, travel |

Consumer-trusted rates & simple widgets |

| Fixer.io |

170+ |

~60 seconds |

Yes |

Developers, SMEs |

Straightforward REST API & SSL |

| Cuurencylayer |

160+ |

~60 seconds |

Yes |

SaaS, startups |

Easy onboarding, historical data |

| IBRLIVE |

Global + INR-First |

Real time (<1 second) |

Limited |

Indian fintechs, AD II forex firms |

RBI-aligned data, sub-second latency, local compliance |

Global Benchmarks: Currencylayer, Fixer, XE, and OANDA.

- OANDA is an expert in trading infrastructure and has a lot of historical data for quant models and live forex trading charts. It costs more and takes longer to develop the middle ground.

- XE is great for apps that need live currency rates on websites or travel apps, but its API updates are slower.

- Developers like Fixer.io and Currencylayer because they have free tiers and fast REST connections. But their INR accuracy usually depends on feeds from other sources instead of government rules.

All of these are great choices around the world, but none of them were made with India’s latency or compliance needs in mind.

What Makes IBRLIVE Different: Its Local Edge

IBRLIVE meets that need by making India’s first Reliable Exchange Rate API available to everyone around the world.

More and more Indian payment gateways, CRMs, and AD II FX companies are choosing it for the following reasons:

- INR Precision: Prices come straight from reliable market sources and Indian retailers that have been given permission to sell.

- Latency is low: Its data pushes every second are very helpful for live dashboards and trading live chart interfaces.

- Regulatory Alignment: Follows the rules set by the RBI, which makes it easier for licensed businesses to do the same.

- Scalable infrastructure: Scalable infrastructure is a must for finance apps that get a lot of traffic because it can handle thousands of API calls at once.

IBRLIVE is better than OANDA when it comes to immediacy and localization, which are two important things for businesses that send real money in Indian rupees.

The Secret Cost of “Free” APIs

A lot of businesses start with a free currency API, but when the market changes, they find out what’s wrong.

Think about a small money transfer app that you could find on Reddit in the r/fintech section. The developers used a free currency conversion API plan that was updated once an hour. On Friday night, shocking US inflation data sent the USDINR through the roof. The app said that the dollar rate today live was ₹81.90, but it was actually ₹83.00. In less than an hour, 200 customers said their purchases had only been partially credited. They lost money on refunds because of the “free” deals and got a bad rating on the Play Store.

Having old information about money is worse than not having any at all.

Case Study: Trader’s Curse and Latency

“In fast markets, five seconds feels like five decades,” one trader said. He wasn’t going too far. When the NFP (Non-Farm Payrolls) numbers come out, spreads get bigger and prices go up by a few points every tick. In short, trading blind apps get real-time FX values every minute instead of every second.

Professional systems stream tick-by-tick feeds for this reason. Retail fintech companies that can’t afford Bloomberg terminals can use APIs like IBRLIVE or OANDA to make their systems more reliable for less money.

Developer Considerations

In addition to the marketing brochures, teams that use these APIs also need the following:

- API Structure: REST/JSON calls like /latest?base=USD return simple key-value pairs for all major pairings.

- Error Handling: Store audit timestamps and fallback rates in a cache.

- Security: Always use HTTPS and API-key authentication because currency data is still financial data.

- Scalability: Keep an eye on the call limits so that the service doesn’t slow down when more people use it.

- Testing: Check the results against feeds from TradingView or Investing.com to be sure they are right.

Not paying attention to any of them will raise your risk without you knowing it, just like leaving an open trade overnight without a stop-loss.

A Fintech Look at IBRLIVE Compared to Other Points of View

For fintech companies that want to work with people in India and other countries:

- Payment Gateways: IBRLIVE works with settlement systems to show official live dollar rates and INR quotes during the checkout process.

- CRMs/ERPs: Companies can use real-time FX widgets to show data about the currency market on their dashboards in real time.

- Trading Startups: With INR rates that change every second, it’s possible to make accurate EUR/USD live chart overlays without having to rely on other people.

- Regulated AD II Firms: Data sources that follow RBI rules help keep audit surprises to a minimum.

IBRLIVE is basically a promise, which is something that free or generic APIs don’t usually do.

Conclusion: Real Time is the Real Edge

Fintech now uses APIs in the same way that trading floors used ticker tapes.

Slow or old feeds are a sure way to lose customers and pip value, just like trading yesterday’s newspaper.

XE and OANDA are still good choices for people all over the world.

Fintech companies that do business in or are connected to India can use IBRLIVE’s Reliable Exchange Rate API to get the right balance of speed, compliance, and INR-centric accuracy. For any big player, all three of these things are important.

Using real-time data can help you stay ahead of the market instead of just keeping up with it.

FAQs

Q1: Which API for exchange rates is the most reliable & accurate for real-time conversions?

A: OANDA and IBRLIVE both offer data from the market that is almost real-time. IBRLIVE, on the other hand, has better coverage of the Indian rupee and the Asian time zone.

Q2: How often do APIs change the dollar or USDINR rates in real time?

A: Free plans usually take a minute or more to update, but premium APIs do it every second or faster.

Q3: Are there reliable, free currency exchange APIs that entrepreneurs can use?

A: Both Fixer.io and Currencylayer have free tiers, but they aren’t very big. They are good for testing, but not for banking apps that people use in real life.

Q4: Why is IBRLIVE a good choice for Indian fintech businesses?

A: It is the best local fit for regulated businesses because it has low latency, INR data that is in line with RBI standards, and a simple REST interface.

by sohamkumar245 | Feb 7, 2026 | Blog

Intro — Everyone wants the “best rate,” but who pays for it?

“Best rate guarantee” is a marketing headline that converts. Users click, they trust, they transact. But for wallets, that promise can be a margin-eater if rates are stale, liquidity is expensive, or hedges aren’t handled smartly. The good news: with the right Exchange Rate Data API approach — real-time data, smart spread logic, and liquidity routing — wallets can keep the promise alive without killing profitability.

What does “Best Rate Guarantee” actually mean for a wallet?

It means you promise customers the best available conversion price at the moment of the transaction (or better), and you back that with execution or rebates. The supporting reality: Wise and other remitters offer guaranteed quotes for a short window; when markets are calm, most providers can fix a rate for a few seconds to minutes. That’s only possible if the wallet is pulling live exchange rate data and executing fast.

Why naive guarantees blow margins (fast)

Small spreads add up. Example: on $10M monthly volume, a 0.15% extra slippage equals $15k gone. If a wallet promises the best visible rate but uses hourly or delayed feeds, customers will see different settled amounts and file disputes. Free or low-frequency free currency converter api feeds (often 60s–60min update) create this mismatch risk. Data from several Exchange Rate Data API providers shows free plans often update less frequently than paid ones, so production wallets usually move to paid, low-latency feeds.

The technical secret: Real-Time Exchange Rate Data API + smart execution = sustainable guarantees

Combine sub-second or second-level live FX rates with execution logic that (a) locks quotes briefly, (b) routes to the best liquidity provider, and (c) buffers margins intelligently. Evidence: enterprise providers like OANDA and IBRLIVE provide tick-level or sub-second data and WebSocket endpoints for streaming updates — which enables quoting, hedging, and automated reconciliation.

How it works in practice:

- Wallet queries its Exchange Rate Data API for a live mid-rate.

- Add a tiny, dynamic spread (e.g., 5–20 bps) based on corridor, volume, and volatility.

- Present a time-limited quote (“quote valid for 30 seconds”).

- On acceptance, execute via the cheapest available liquidity route and hedge any net exposure. This chain ensures customers see a true live exchange rate, and the wallet preserves margin.

Pricing models wallets use to keep promises and preserve margin

Use blended pricing + dynamic fees based on real-time volatility and customer tiering.

Practical, evidence-backed options:

- Tiered Spread: lower spreads for high-value customers; higher spreads for retail, occasional users. (Revolut-style tiering and limit/stop features are examples of user segmentation.)

- Time-Limited Quotes: guarantee the displayed rate for a short window (30s–120s) — this reduces execution risk. Wise offers guaranteed rates for a limited period per transfer.

- Hedging & Netting: aggregate intraday flows per currency corridor and hedge net exposure instead of every single transaction; this reduces execution costs. Industry treasury practice supports netting to reduce hedging costs.

Liquidity routing and margin protection — the operational playbook

Direct answer: route orders to the best provider at the moment of execution and protect margins with slippage thresholds.

Tactics that work:

- Smart routing: evaluate live prices from multiple LPs (market makers, banks) and pick the best net rate after fees.

- Slippage guardrails: if execution price deviates beyond threshold (e.g., >10 bps), automatically cancel or inform the user and offer a rebate/adjustment.

- Post-trade netting and hedging: at the end of short windows, hedge net exposures with a low-spread provider or via FX forwards. These are standard treasury actions that reduce spot hedging costs.

A low-latency fx rate api like IBRLIVE both reduces the frequency of slippage and provides better timestamped proofs for audits and customer dispute resolution.

Case example — how one wallet avoided margin collapse (short, real-world pattern)

Switching from hourly feeds to a real-time feed + dynamic spread saved margin.

Scenario (industry-validated pattern): a mid-sized wallet using 60s/60min free feeds saw 1% intraday FX moves during volatility. They switched to a paid real-time feed, set a 10-second quote window and a 10-bp buffer; net result — dispute volume dropped 70% and effective margin improved. (Multiple developers and fintech founders cite similar improvements when switching to paid, low-latency providers.)

UX & trust: how to word guarantees so customers don’t misinterpret them

Transparency + education = reduced disputes.

UX copy tips that work:

- Show both the live exchange rate (mid-market) and the applied fee/spread. Example: “1 GBP = 1.17 EUR (mid-market); you pay —0.12% fee; final rate 1.1686.” Wise and other transparent remitters use this mid-market + fee disclosure approach.

- Display quote expiration time (e.g., “Quote valid for 45s”).

- Provide historical small print about how exchange rate moves are market driven — and show a eur usd live chart or gbp usd live chart so sophisticated users can verify. Having a forex trading live chart or live currency charts available reduces “I saw a better rate elsewhere” claims.

Why IBRLIVE is built for wallet “Best Rate” programs (India + global corridors)

IBRLIVE combines India-centric accuracy with low latency and developer-friendly Exchange Rate Data API — which is a strong match for wallets that run high volumes in INR corridors.

Key proof points from IBRLIVE docs and product positioning:

- Sub-second updates and WebSocket/REST endpoints for streaming rates and quote timestamps.

- INR-focused feeds sourced with regulatory alignment (useful for AD-II and wallets operating in India). This reduces reconciliation variance vs. global providers.

- Developer tools for testing and sandboxing — essential before rolling out “best rate” guarantees to production.

For Indian corridors (and global corridors connected to INR), IBRLIVE can reduce both slippage and compliance friction compared to generic free APIs.

Practical implementation checklist (what your product + engineering teams must do)

- Use a reliable live feed (sub-second or a few-second refresh) — avoid free hourly feeds for production.

- Quote with expiration (30–120s) and display it clearly.

- Dynamic spread engine — adjust spread by corridor, volatility, and customer tier.

- Smart routing & hedging — route to LPs with best net rate; net flows before hedging.

- Audit logs — store rate IDs and timestamps for dispute and compliance.

- Fallback providers — maintain a secondary API to avoid downtime reliance on a single free provider.

FAQs

Q1: Can wallets use a free Exchange Rate Data API for “Best Rate” programs?

A: For prototypes, yes. For production “best rate” promises, no — free plans often have slower update intervals (60s–60min) and lack enterprise SLAs. Paid, real-time feeds are the standard.

Q2: How short should the quote validity be?

A: 30–120 seconds is common. Shorter windows (e.g., 10s) are possible with tick feeds and low latency, but may increase abandonment if users are slow at checkout. Balance UX and execution risk.

Q3: Does offering a guaranteed rate mean you must hedge every transaction?

A: Not necessarily. Many wallets net exposures intraday and hedge the net position, which reduces hedging costs. Hedging every micro-transaction is expensive and unnecessary if netting is possible. Treasury best practice supports netting and pooled hedging.

by smijoy24 | Dec 28, 2025 | Exchange Rate API

Cross border payments look simple on a whiteboard. “Take $100, turn it into rupees, and send it overseas.” Easy, right? Except when you’re the one building the system, it feels less like arithmetic and more like juggling fire. One bad forex conversion, and suddenly you’re facing irate customers, refund requests piling up like Monday morning emails, and a CFO wondering why the forex numbers don’t add up.

I’ll never forget what a developer once told me about the day their money transfer app melted down. They had been using a free API for currency rates to cut costs. On a Friday — because of course disasters love Fridays — the markets were unstable. His phone wouldn’t stop buzzing with Slack alerts. The foreign exchange rates showing in the app were different from what customers were charged. “It felt like my own code had betrayed me,” he admitted. What followed was a chaotic weekend: thousands of dollars lost to refunds and a string of one-star reviews that haunted their Play Store listing.

Lesson learned? In the world of currency exchange, accuracy isn’t optional. It’s survival.

Why Accuracy in Forex Data Matters?

1. Trust is Delicate

Users don’t just want to see live foreign exchange rates — they demand them. Imagine buying a $100 jacket and finding your card charged ₹9,000 instead of ₹8,200. Would you return to that store? Probably not.

2. Margins Disappear Quickly

The markets never stand still. A tiny slip in an API for currency rates can cost businesses money — or worse, cost users their trust. SMEs in the UK are estimated to lose around £90,000 a year to poor FX practices. That’s not a rounding error; that’s a salary gone.

3. Pricing with Confidence

Every currency exchange app lives or dies by this: $100 should equal exactly what you promised in euros, yen, or rupees. Anything else means disputes, distrust, and dreaded support tickets that begin with “Why was I charged…?”

4. Real-Time or Bust

Delays destroy confidence. Reliable API for currency rates refresh every 30–60 seconds, sometimes faster. Without that, you’re quoting yesterday’s market in today’s transaction. That’s like serving last night’s leftovers at a five-star restaurant. No one’s impressed.

5. The Basics of Automation

Every money exchange app is just gears turning behind the curtain. If your forex tool isn’t reliable, the gears grind to a halt. Reconciliation fails, audits break, and instead of building new features, your developers spend weekends patching bugs.

The Real Cost of Getting it Wrong

Let’s be honest. Without a solid API for currency rates, you’re asking for:

- Refunds piling up like unread emails.

- Regulators breathing down your neck (PSD2, CBPR2 don’t play nice with hidden spreads).

- Settlement delays that turn “instant transfers” into “maybe next week.”

- Worst of all? Users telling their friends never to use your app.

And once trust evaporates in foreign exchange, it rarely comes back.

How Real-Time Rate Services Save the Day

APIs today aren’t fancy add-ons; they’re lifelines:

- Live Accuracy: Updates every few seconds so there are no surprises at checkout.

- Credible Sources: Rates pulled from central banks and interbank feeds, not someone’s half-updated spreadsheet.

- History on Demand: Need to prove what rate you used last April at 3:15 PM? The good ones have it logged.

- Crypto-Friendly: Users expect BTC→USD or ETH→INR conversions. If your provider can’t deliver, they’ll look elsewhere.

- Developer-Friendly: REST/JSON, simple docs, secure keys. Because integrating an API for currency rates shouldn’t feel like assembling IKEA furniture blindfolded.

What Developers and Founders Are Saying

- Developers on DEV.to recommend APIs with batch conversion support and broad currency coverage to keep systems efficient.

- Trio.dev points out that today’s cross border payments still lean on slow SWIFT rails. The future? CBDCs and blockchain rails. Translation: choose an API that’s ready for tomorrow, not just today.

Case Study: 3S Money’s Big Win

Take 3S Money, a UK-based fintech. They were buried under hidden costs, mismatched rates, and endless manual reconciliations. Their solution? An API for currency rates that locked in interbank rates. The results were transformative: faster payments, transparent pricing, and clients who finally felt confident in the service.

It’s proof that the right API for currency rates doesn’t just prevent disaster — it powers growth.

The Providers You Should Know

| Provider |

Coverage |

Update Frequency |

Notes |

| XE |

170+ currencies |

60s to daily |

Aggregates 100+ sources, globally trusted |

| Currencylayer |

168+ + crypto |

60s (paid plans) |

19 years of historical data, easy JSON |

| FastForex |

145+ + crypto |

60s |

1M free calls/month, 9+ years of history |

| Open Exchange Rates |

200+ currencies |

Hourly (free) to live |

Strong developer community, simple setup |

| IBRLIVE |

3000+ currencies |

Real-time interbank |

RBI-licensed, SME pricing from $9, plus forecasting tools |

Why IBRLIVE Deserves Attention

Most APIs just spit out numbers. IBRLIVE builds trust. With real-time interbank rates, RBI licensing, and forecasting tools, it’s made for businesses that can’t afford to gamble on FX accuracy. And starting at just ₹765/month, even SMEs can get enterprise-level forex solutions.

Think of it like flying: lots of providers give you a cockpit. IBRLIVE gives you a cockpit with radar.

Wrapping It All Up

In the world of currency exchange and cross border payments, accuracy isn’t a bonus — it’s the baseline. A reliable exchange rate API or currency converter API means:

- Users always know exactly how much they’re exchanging.

- Compliance is built in, not bolted on.

- Developers don’t spend weekends firefighting API fails.

Providers like IBRLIVE show that when data is right, payments flow smoothly, customers stay happy, and businesses grow without friction.

So next time you’re tempted to save a few bucks with a free feed, ask yourself: is risking trust, money, and your sanity worth the $50?

by smijoy24 | Dec 28, 2025 | Blog

On paper, running a global business feels glamorous. You send an invoice in euros, your client pays in dollars, and you finally reconcile it all in rupees—assuming your Free Currency Converter API keeps everything accurate. Easy, right?

Not quite.

Reality is messier. Picture this: it’s midnight, you’re hunched over your laptop with a cup of chai that went cold hours ago. The Excel sheet is open, the exchange rates don’t match, and your auditor is pinging you with questions you don’t want to answer. That’s the real face of “multi-currency accounting” for many Indian businesses—especially when you’re not using a reliable Free Currency Converter API.

The Pain of Manual Rates

Take Rajiv, for example. He runs a small handicrafts export business in Jaipur. A few months back, he billed a U.S. client in dollars using last week’s INR/USD rate. By the time the payment came in, the market had shifted. The difference? A painful ₹35,000 gone from his margin—money he couldn’t afford to lose.

Rajiv laughed it off later, saying, “Bas, this is what happens when you trust jugaad over systems.” But the truth stung. Outdated rates had cost him both profit and credibility.

This isn’t just Rajiv’s story. It’s the story of countless exporters, consultants, freelancers, and SMEs who are trapped between spreadsheets and half-baked software solutions.

How Tally, Zoho, and QuickBooks Try to Help

Each platform has its strengths—and its blind spots.

TallyPrime is flexible, yes, but it’s also stubbornly manual. You have to type in exchange rates by hand on the Currency Alteration screen. It will calculate gains and losses automatically once the payment comes in, but without live updates, you’re stuck playing catch-up with the market.

Zoho Books and Zoho Invoice do better with automatic feeds from Open Exchange Rates. That’s a relief, but it still means you’re limited by their default sources. And let’s not forget: only higher-tier plans unlock multi-currency features. As one Zoho user told me, “I spend more time convincing my accountant about Zoho’s rates than I do convincing clients to pay me.”

QuickBooks Online feels smoother on the surface—it refreshes rates every four hours. But once you enable multi-currency, there’s no going back. And rates are “locked” at the moment of invoice creation. Great if the market stays calm. Risky if you’re dealing with forex volatility that moves faster than you can say “INR/USD spike.”

Where a Free Currency Converter API Changes the Game

This is where a Currency Converter API steps in like a breath of fresh air. No more late-night refreshes of Forex Factory. No more “jugaad” rates scribbled on sticky notes. An API quietly feeds accurate, up-to-the-minute forex data straight into your accounting system.

Think about it: invoices reflect the latest market values. Payments reconcile smoothly. Your gains and losses are transparent enough to make auditors smile instead of frown. And for once, you can focus on growing your business instead of babysitting spreadsheets.

The Everyday Impact

For exporters like Rajiv, it means no more losses because of outdated rates. For study-abroad consultants, it means seamless invoices in GBP, CAD, or AUD without frantic recalculations. For e-commerce businesses, it means customers see prices in their own currency, live and accurately. And for SMEs with tight margins, it means peace of mind. No surprises. No hidden shocks. Just clarity.

Because at the end of the day, whether you’re tracking gains, managing exposure, or just trying to keep reconciliations clean, the right FX integration doesn’t just give you numbers—it gives you confidence.

Building Confidence in Exchange Rates:

Ever struggled with unreliable rates in your accounting software? I’ve seen exporters lose precious margins because the number on the invoice didn’t match the actual market rate when the payment came in. In my experience working with them, plugging into a reliable exchange rate API literally saved hours of manual updates each week and reduced those awkward calls from clients asking, “Why doesn’t this amount add up?”

Enter solutions like IBRLIVE. Instead of giving you delayed figures, it delivers interbank foreign exchange rates in real time—no hidden spreads, no guessing games. For Indian businesses, the RBI license behind it adds peace of mind. And the predictive tools and alerts? They mean you’re not always chasing the market—you’re one step ahead of it.

Imagine invoicing a U.S. client through Tally without any currency surprises. Or sending out a GBP invoice in Zoho and knowing it matches the true market rate without second-guessing. Even QuickBooks Online users, who often hit the wall with rigid rate locking, can finally breathe easier when a currency exchange api helps smooth out the bumps.

And the cost? Plans starting at around ₹765/month are cheaper than what many exporters spend on couriering physical invoices abroad. That’s a small price for dependable currency conversion that helps your business avoid forex headaches.

The Bottom Line

In today’s world, accurate foreign exchange data isn’t a luxury—it’s survival. Whether you use Tally, Zoho, or QuickBooks Online, your numbers are only as good as the exchange rates powering them.

A Free Currency Converter API like IBRLIVE doesn’t just save time. It saves margins, protects credibility, and lets you sleep a little easier at night.

So, before you type in another manual update or trust a week-old rate, ask yourself: is it worth the risk?

Rajiv would tell you otherwise.

by smijoy24 | Dec 28, 2025 | Exchange Rate API

Ever tried building a forex trading app and thought, “How hard could it be?” On the surface, it seems simple—just pull prices from a currency exchange rate API and display them to users. But in reality, foreign exchange data doesn’t arrive calmly; it moves fast, spikes suddenly, and can turn unforgiving in volatile markets. One wrong design decision, and users are left staring at frozen or outdated rates while the market races ahead.

So when it comes to WebSocket vs REST, which path do you choose? Let me walk you through it with a few scars from my own journey.

Currency Exchange Rate API via REST: Stability and Simplicity

When I first hacked together a trading bot, I leaned on the REST API. Why? Because it just worked. You send a request, you get an answer—end of story. No drama. In the WebSocket vs REST debate, REST often feels like the dependable old friend.

REST is like the guy in your office who never shows off but always delivers. Want to place an order? REST can handle it. Need yesterday’s EUR/USD data for your day trading simulator? REST’s got your back. Checking balances or grabbing a quick portfolio snapshot? Again—REST keeps things tidy.

Once, while prototyping a simple trading tool for college traders, I stuck with REST purely because I didn’t trust them (or myself) not to break a WebSocket setup. In WebSocket vs REST, REST gave me the consistency to focus on the UI instead of debugging broken connections.

Currency Exchange Rate API via WebSocket: Speed and Live Streaming

Then came the time I needed tick-by-tick prices. REST wasn’t cutting it. Polling every second felt like sipping through a straw during a flood. That’s when I switched to a WebSocket API—and instantly felt the power shift in the WebSocket vs REST battle.

WebSockets shine when:

-

You want live FX data with zero lag.

-

You’re chasing trades where milliseconds matter.

-

Your charts must react instantly when USD/JPY sneezes.

-

You’re tired of wasting bandwidth with constant polling.

But WebSockets aren’t flawless. I’ll never forget the night my WebSocket client dropped mid-London session. Prices kept moving, but my app was blind. By the time I reconnected, the damage was done. Debugging WebSocket reconnections at 2 a.m. is the part of WebSocket vs REST nobody glamorizes.

Still—if you’re serious about competing with the best forex trading platforms, WebSockets are non-negotiable.

Do You Really Have to Pick Sides?

Here’s the honest truth about WebSocket vs REST:

You don’t need to choose. The smartest trading platforms use both.

Use WebSocket for:

Use REST for:

-

Order execution

-

Account info

-

Historical queries

Think of WebSocket vs REST as running a trading desk with two specialists—one shouting every tick, the other managing structured tasks calmly. Together, they’re unstoppable.

That’s why the best day trading platforms follow a hybrid model.

The Trade-Offs Nobody Talks About

In the WebSocket vs REST comparison, both protocols have strengths and quirks:

-

Complexity: REST is simple. WebSockets require lifecycle and reconnection handling.

-

Security: Both support SSL, but persistent WebSocket sessions require monitoring.

-

Scale: REST scales easily. WebSockets need planning for thousands of concurrent connections.

-

Use Case Fit: Trading simulators may thrive on REST, while professional platforms demand WebSockets.

Understanding these trade-offs helps you build smarter fintech systems.

What It Looks Like in Practice

Here’s how WebSocket vs REST plays out in real-world trading apps:

-

Dashboards: REST fetches account history; WebSocket feeds real-time tickers.

-

Day Trading Simulators: REST supplies historical data; WebSocket mimics real-time feeds.

-

Pro Platforms: Both work together—REST for reliability, WebSocket for speed.

This dual approach delivers the experience traders expect.

Why WebSocket or REST Won’t Save a Weak Currency Exchange Rate API

You can win the technical battle but lose the war if your data feed is weak.

I learned this the hard way when my bot quoted a stale USD/INR rate. Even the perfect WebSocket vs REST setup can’t save you if your prices are inaccurate.

That’s where providers like IBRLIVE make a difference. They deliver real interbank rates, in real time, through both REST and streaming APIs. RBI licensing adds trust, while pricing remains SME-friendly. Whether you’re on Zoho, QuickBooks, or building your own forex trading app, a dependable feed is what keeps users loyal.

Wrapping It Up

So what’s the verdict on WebSocket vs REST?

It’s not a boxing match—it’s a partnership.

-

REST is your steady worker—great for stability, structure, and historical data.

-

WebSockets are your adrenaline junkie—built for live streaming and instant updates.

If you’re building a forex trading app, experimenting with a day trading simulator, or chasing the standards of the best trading platform—don’t choose. Use both.

Because in forex, milliseconds matter—but so does reliability.

And the platforms that win? They’re the ones smart enough to balance both.

by smijoy24 | Dec 28, 2025 | Exchange Rate API

Changes in currency values are now one of the biggest threats to Indian exporters’ revenues. Things like geopolitical tensions, shifting interest rates, and commodity cycles can make exchange values change a lot in just a few days or even hours. Because most Indian exports are paid for in USD, EUR, GBP, or AED, these fluctuations have a direct influence on margins, cash flow, competitiveness, and long-term planning. This is exactly why many exporters are now turning to a Foreign Exchange API to track these movements in real time and reduce uncertainty.

Exporters don’t need calls from banks that take a long time to get through, static spreadsheets, or rates from yesterday. They need real-time currency information—and this is where an Foreign Exchange API becomes essential. A reliable Exchange Rate API can help significantly with making hedging decisions, sending accurate invoices, and generating timely predictions.

The Problem: INR Risk and Unstable FX

The money is still made in INR even when an exporter bills a buyer in USD or EUR. If the currency changes between the time the invoice is sent, the shipment is made, and the payment is made, it could cut into profits.

Exporters often have to cope with these issues:

- It’s hard to forecast how the USD/INR will move.

- Relying on rates set by banks

- Costs are wrong because of obsolete data

- Losing money when settlements are late

- Buyers disagree on how clear the conversion is

If you charge 1 USD = ₹82.20 but the rate drops to ₹81.45 by the time you get paid, you lose ₹0.75 per dollar, which is a lot of money if you do a lot of business.

Why Exporters Can’t Rely on Old Methods

| Old Method |

Problem |

| Getting quotes from banks over the phone |

Slow, not always the same, and depends on what you think |

| Checking rates on Google |

Not good enough for businesses; there’s no way to check rates |

| Tracking by hand with Excel |

Slow to respond and easy to make mistakes |

| Just using Fed/RBI circulars |

Not in real time |

Exporters need data supplied immediately to their systems that is real-time, automated, and dependable.

Three Main Ways Foreign Exchange API Can Help

1. Hedging based on timing and data

Instead than hedging solely on gut emotions or quotes that come in late, exporters can perform the following:

- Set up automatic hedge triggers, like “hedge if USD/INR goes below 82.00.”

- Watch the spreads between banks and between banks and other banks.

- Use forward cover more wisely

Live FX APIs enable exporters to respond in minutes instead of hours, which decreases the risk on open exposures.

2. FX invoicing that is more open and smart

A lot of exporters can’t negotiate anymore since buyers want precise invoices.

APIs let you:

- Live billing in USD/INR after the invoice is sent

- Buyers can see locks on rates

- Adjusted proforma bills for foreign exchange

The end effect is fewer arguments, quicker closings, and more trust.

3. Making plans for financial flow and predicting it

Exporters need to be able to make accurate guesses about how the foreign exchange market will move so they can plan production cycles, procure raw materials, and keep an eye on their credit risk.

Exchange Rate APIs work with ERPs, accounting software, or internal pricing systems to aid with:

- Mapping cash flow by month

- Scenario planning (the best and worst-case FX)

- Guessing how much money you’ll make before you take orders

Forecasting changes from being reactive to being proactive.

How to Use FX API, ERP, and Your Bank in Real Life

This is how a simpler workflow looks:

| Step |

The System |

What to Do |

| 1 |

API |

Get real-time rates for USD/INR, EUR/INR, and GBP/INR. |

| 2 |

SAP, Tally, and ERP |

Apply rates to costs and bills |

| 3 |

Bank/AD |

Execute a hedge or convert at the best rate. |

This means that currency is the only source of truth, which makes it easier for the finance, sales, and treasury departments to operate together.

Comparison in the Real World: A Situation Without an API and One With a Live Foreign Exchange API

| Aspect |

Without API |

With Live FX API |

| Rate of billing |

Doesn’t change or takes a long time to alter |

Understanding of real-time rates |

| Hedging |

Make a guess |

Data-based alerts |

| Predicting |

Old and done by hand |

Correct and automated |

| Effect on profit |

Leaking margin |

Cover for the margin |

What to Look for in a Live Foreign Exchange API:

Exporters should choose an API that has:

- Rates between banks in real time

- Access to old data

- Seeing the bid and ask

- Secure REST API

- A lot of time online

- Currency pairs that have INR as their main emphasis

You can use Live Foreign Exchange API like IBRLIVE, Open Exchange Rates, and Currency layer to aid with these tasks. (IBRLIVE is especially helpful for INR pairs that can only be found in India.)

In the End

Changes in the global economy are natural, but losses don’t have to be big. Indian exporters can:

- Strengthen ways to hedge

- Make your bills easier to read

- Make sure you can make forecasts

- Even when things are unstable, keep margins safe.

Real-time FX data changes doubt into a plan. Exporters who use these tools will do better than those who still do things the old-fashioned way.