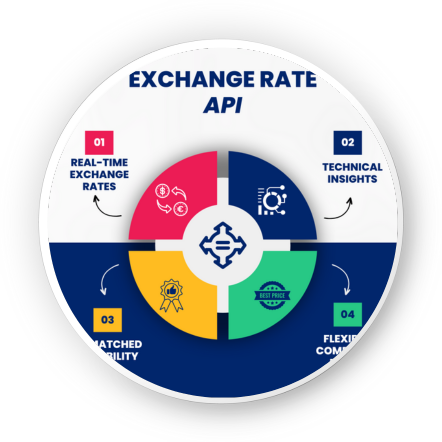

Your Forex Our Expertise

Get the latest IBR rates, live USDINR updates, live dollar to rupee exchange rates, interbank exchange rates, and USD dollar live rates. Stay informed with real-time currency data.

Live Interbank Exchange Rates

Check IBR rates, live USDINR rates, live dollar to rupee exchange rates, interbank exchange rates, and USD dollar live rates

Currency Pair

Rate

Delete

Real Time Exchange Rates ( Mid Market Values)

Real Time Exchange rates (Mid Market Rates/Interbank Rates/Spot rates)- Mid Market rates are average of buy & sell transactional rates of a currency pair.

These rates are just for reference purpose and not for transaction purpose.

Our Achievements

USD 100 Million+ Remitted abroad hassle-free

Saved millions of rupees as exchange margin

100+ Satisfied Corporates

1 USD ($)

1 USD ($) 1 EUR (€)

1 EUR (€) 1 GBP (£)

1 GBP (£) 1 AUD ($)

1 AUD ($) 1 CAD ($)

1 CAD ($) 1 NZD ($)

1 NZD ($) 1 AED (د.إ)

1 AED (د.إ) 1 SGD ($)

1 SGD ($) 1 THB (฿)

1 THB (฿) 1 CNY (元)

1 CNY (元) 1 JPY (¥)

1 JPY (¥) 1 CHF (₣)

1 CHF (₣) 1 MYR ()

1 MYR ()